Uber-backed Moove, an Africa-born mobility fintech that offers vehicle financing to ride-hailing and delivery app drivers across six continents, has acquired Kovi, a Brazilian urban mobility provider.

The value of the deal is not being disclosed, but Moove confirmed it was an all-share transaction, and Kovi is now wholly owned by Moove.

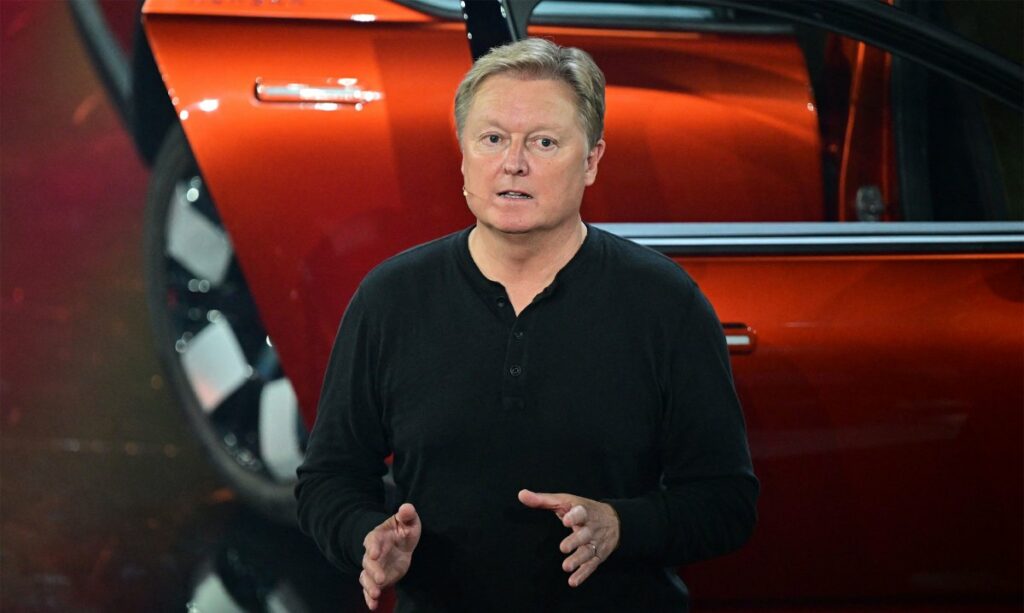

Moove co-founder and co-CEO Ladi Delano told TechCrunch that the deal bumps the mobility fintech’s annual revenue to $275 million. Last March, Moove reported a $115 million ARR.

The news comes two months after Moove announced a partnership with Waymo to provide driverless vehicle fleet operations in two U.S. cities, Phoenix and Miami.

Delano said Moove’s acquisition of the São Paulo-based Kovi marks a significant step toward the company’s goal of building the world’s largest ride-share fleet. What began with 76 cars in Lagos, Nigeria, in 2020 has now grown to 36,000 cars operating in 19 cities across six continents, with Latin America now emerging as a key market.

Similarly, the acquisition unites two companies tackling the same challenge—providing financing solutions for ride-share drivers. Founded in 2018, Y Combinator-backed Kovi launched to make vehicle ownership more accessible in Brazil. Following the acquisition, pending approval from the Brazilian antitrust authority, Kovi will continue to operate under its brand while its executive and management teams will remain unchanged.

While Moove will keep the Kovi brand operating in its existing markets, Brazil and Mexico, there are plans to expand further across Latin America. Moove recently launched operations in three cities across Colombia and Mexico. As such, the acquisition further cements Moove’s position in Latin America, giving the company a major foothold in Brazil, the region’s largest ride-hail market.

“We’re incredibly excited about working with a fantastic team of like-minded individuals at Kovi who set up this business to address a similar problem that we found in Nigeria,” he remarked. “Kovi is one of the top two players in Brazil. So we have not just entered or strengthened our presence in the Latin American market but also put ourselves in a top two position in the largest single market in Latin America through this acquisition.”

Moove has built a third pillar in the global mobility marketplace by offering vehicle supply to ride-hailing platforms. This includes its flagship Drive-to-Own product, a taxi and employment model, and an emerging autonomous vehicle (AV) business line involving AI-driven mobility.

While AI plays a key role in its AV business line, Delano says the company’s AI mobility strategy will span the entire business, from optimizing traditional ride-hailing services to improving fleet management, according to Delano. This is where the Kovi acquisition comes in. According to the chief executive, Kovi’s proprietary technology and algorithms will “complement and strengthen our existing move AI mobility strategy and ensure that we can start to deliver an improved service and product to our customers around the world.”

It’s unclear whether Kovi was struggling financially before its acquisition by Moove. Its last known funding round was a $104 million Series B in 2021 from investors like Valor Capital, Prosus Ventures, and Quona Capital. Despite raising funds to expand across Latin America, Kovi primarily focused on Brazil. That year, it reported $45 million in ARR, growing 15% month-over-month.

The all-share transaction makes Kovi’s investors shareholders in Moove, aligning their growth trajectories. In a statement, Kovi CEO Adhemar Milani Neto expressed confidence in the deal. “I met the founders [Moove’s Delano and Jide Odunsi] many years back when they were scaling their business in Africa, and I was immediately impressed by their purpose-driven approach, which is also a perfect match to our culture. Together, I believe we will become a truly global category-defining business and will leverage scale and deep expertise never seen in our market.”

Moove, which raised a $100 million Uber-led Series B last year at a $750 million valuation, has financed over 50 million Uber trips globally, it claimed. The mobility fintech has secured over $500 million in debt and equity from backers like Mubadala, BlackRock, Franklin Templeton, Janus Henderson, and the IFC (World Bank) since its launch five years ago.

Delano declined to comment on potential new fundraising efforts. Instead, he stressed that the company will focus on driving its capex-heavy business to profitability this year and realizing its vision of building the largest ride-hailing fleet globally.