Swedish electric vehicle maker Polestar saw its first-quarter sales jump 76% compared to the same period in 2024 after it began offering discounts and other promotions, including ones geared towards locking in Tesla owners.

Polestar sold 12,304 cars in the first three months of the year compared to 6,975 in Q1 2024. Sales were relatively flat quarter-over-quarter, even amidst competition from other automakers and an uncertain economic outlook.

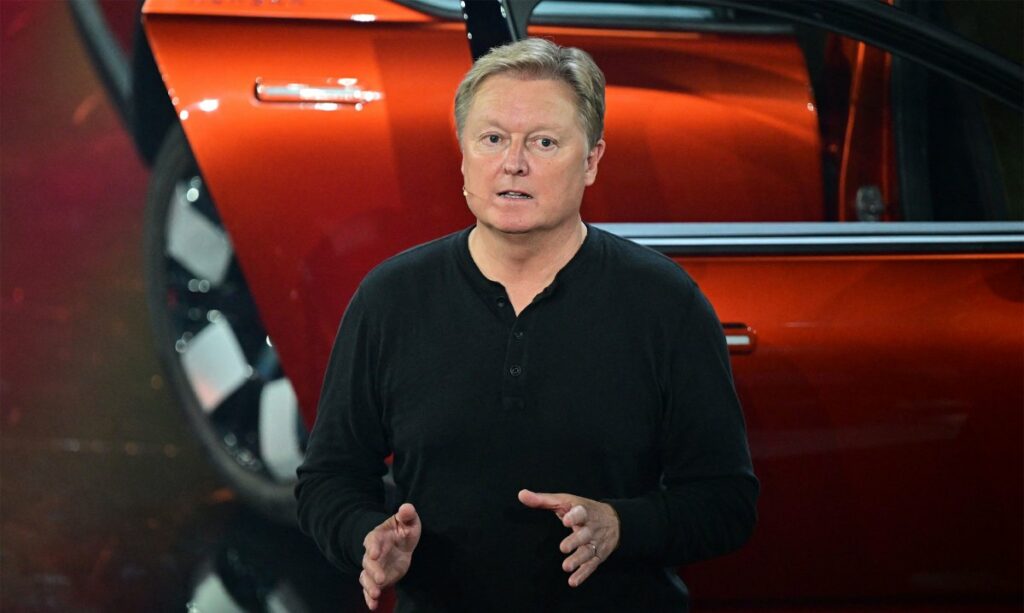

“We are on the right track and doing the right things,” Michael Lohscheller, Polestar CEO, said in a statement. “With a more active selling model, more retail partners and attractive cars, we are delivering results.”

One of Polestar’s more “active selling” strategies has been to tap into Tesla’s brand devaluation due to its CEO Elon Musk’s involvement in DOGE. The company recently started offering up to $5,000 in discounts for Tesla drivers looking to lease the company’s new Polestar 3 crossover.

Polestar makes the Polestar 2 electric fastback, the Polestar 3 electric SUV, and, soon, the Polestar 4 electric SUV coupe. The automaker doesn’t break out its sales numbers by models, but in March after Polestar began offering its Tesla conquest bonus, head of sales Jordan Hofmann posted on LinkedIn that orders for the Polestar 3 had been “incredible.”

Tesla has also relied on discounts to boost sales numbers, and those have affected its bottom line.

It won’t be clear for a few months how the discounts have affected Polestar’s margins; the automaker said in February that it would delay publishing its full-year and Q4 2024 earnings until the end of April after it secured a $450 million loan to keep the company afloat as it burned through cash.

The durability of Polestar’s discounts is unclear as the fallout from President Donald Trump’s sweeping tariffs and ensuing trade war could drive up car prices. Polestar manufactures in the U.S. and China, and plans to make the Polestar 4 in South Korea in the second half of 2025.

“We are monitoring closely and assessing the volatile geopolitical environment and will adapt as needed,” Lohscheller said.

Polestar does appear to be making changes to its business in China, though it’s not yet clear if it’s a response to the geopolitical climate or simply a shift in strategy.

In a filing Thursday, Polestar, which is owned by China’s Geely, noted that it had agreed to end a joint venture in China with Xingji Meizu, a mobile phone and consumer electronics company. The two joined up in 2023 to build an operating system for Polestar cars sold in China, and now will transfer the distribution rights of the JV to Polestar.

The JV, which is called Polestar Times Technology, will settle any outstanding debts before it ceases operations, per the filing, and will transfer “certain digital and other assets from the JV with arms-length consideration” so Polestar can resume sales, customer service, and distribution in the Chinese market.

The filing notes that the parties are terminating the JV “as a result of a change in market focus and strategy” but that Polestar would remain “fully committed to the Chinese market.”

TechCrunch has reached out to Polestar to learn more about how this affects its strategy in China.