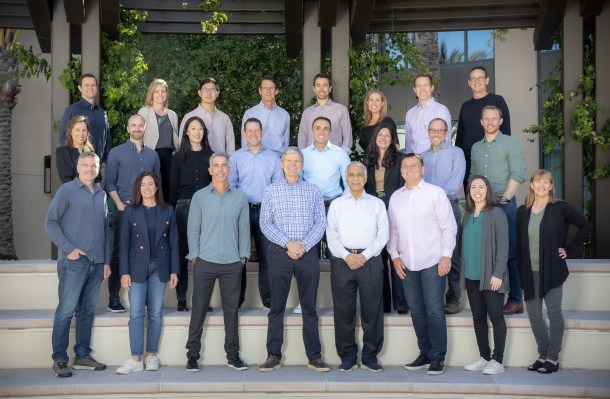

Norwest Venture Partners, a 65-year-old firm backed solely by Wells Fargo, has raised its 17th fund at $3 billion.

That’s a noteworthy number, given that NVP last raised the same amount in December 2021. That was the peak of the venture boom, and at that time, the firm said it increased its capital pool by 50% (NVP’s 2019 fund closed at $2 billion) because it needed to stay competitive in the dealmaking environment where round sizes and valuations have climbed to unprecedented levels.

But things have obviously changed since then. Investors are backing fewer companies, and valuations have dropped and may fall further.

Jeff Crowe, a senior managing partner, admitted that the investment rate in venture and certain sectors is slower than it was several years ago, but he said that dealmaking in certain strategies, sectors and geographies, such as growth equity, healthcare and India, is as robust as it was before the downturn.

“We’ve kept a very steady pace and have delivered a number of nice exits,” Crowe told TechCrunch. “We felt it makes sense to keep going at the same pace.”

Since closing its previous fund, the firm has helped 36 companies realize liquidity. Not all exits were great outcomes for the firm (NVP’s portfolio company VanMoof filed for bankruptcy protection), but returns from certain exits greatly outweighed the losses, according to Crowe. He pointed to the firm’s sale of Spiff to Salesforce, the buyout of Avetta by EQT for a reported $3 billion and the IPO of Indian-based Five Star Business Finance.

Crowe declined to comment on returns, but said: “This is fund 17. We’ve been doing this for a long time, and in the venture world, you get to stay in business if you deliver really good returns.”

NVP attributes much of its success to operating out of one large global multi-strategy fund. The firm invests in North America, India and Israel. It has an early-stage and growth equity business, and has recently added a biotech team to round out its existing healthcare practice.

The diversified approach allows the firm to adjust its strategy when the market changes. For instance, NVP planned to invest in crypto companies when it raised its last fund, but the sector fell out of favor shortly after that, and the firm didn’t pursue many deals in the space.

“Our diversified strategy works well through ups and downs of investment cycles,” Crowe said. “It gives us flexibility. That’s the beauty of it. We react faster to changes.”