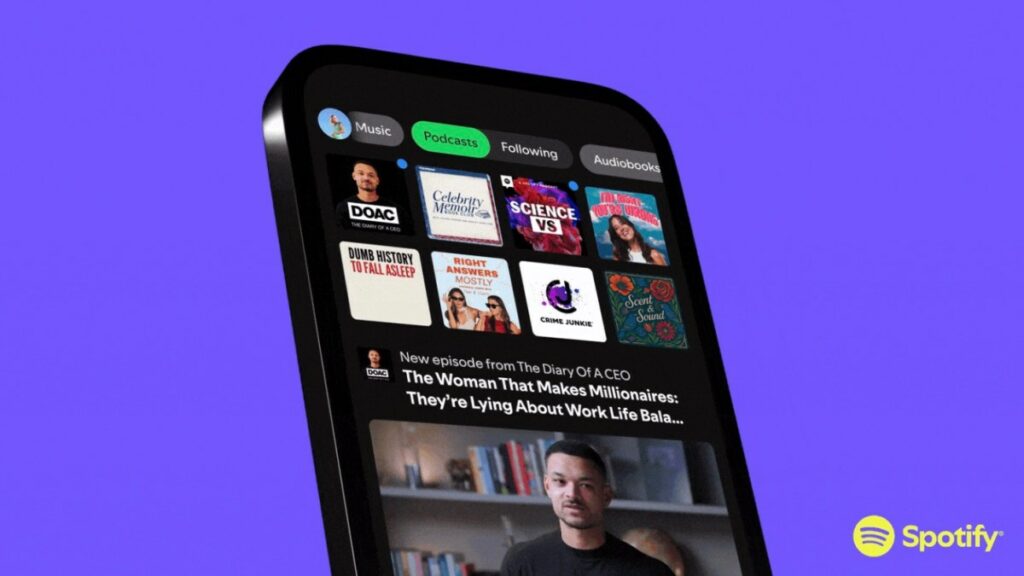

Spotify says its video podcasts are seeing increased consumer adoption. In its third quarter earnings report, the company shared that its video podcast catalog has expanded to nearly half a million shows, and more than 390 million users have now streamed a video podcast on the platform.

That figure is up 54% year-over-year, and it also reflects Spotify’s increased investment in the format. In June 2024, the company said it had some 250,000 video podcasts as it rolled out tools that let non-hosted podcasters upload their videos to the platform. The streaming giant also lets users engage with podcasts through comments, Q&As, and polls, making the app feel more like a social network.

As a result, Spotify says that users’ time spent with video content on Spotify has also more than doubled year-over-year, largely driven by video podcasts. In addition, video podcast consumption has increased by more than 80% since the launch of the Spotify Partner Program, or SPP, in January, which gives qualifying creators the ability to monetize their shows in new ways, including audience-driven payouts from Spotify Premium user engagement.

The company also recently announced a partnership with Netflix to distribute its video podcasts to a broader audience starting in 2026 in the United States, with more markets to follow. Investors didn’t ask about the specifics of the revenue-sharing agreement on the earnings call; however, investors did want to understand how distributing podcasts off the platform would ultimately benefit Spotify.

According to incoming co-CEO Alex Norström, the move is meant to center Spotify as creators’ distribution hub.

“We think… that when the creator wins, we win, and as creators optimize to create their best shows and interviews, which is really what they’re focused on,” Norström told investors and analysts. “They wanted to syndicate everywhere. And we believe, of course, in helping them to reach audiences in as many places as possible, which is consistent with our core philosophy on being creator-first.”

Later, co-CEO Gustav Söderström suggested that allowing creators to be both on Spotify and Netflix gives the company further “revenue opportunities.”

“This is the way to think about it: It’s part of our ubiquity strategy, and it’s really important that while we build a good user experience, we also need to have a very strong creator offer[ing],” he noted.

Norström pointed out that having Spotify podcasts on YouTube increased awareness about the shows and their origins, which then resulted in net incremental usage on Spotify. The company expects the same with Netflix.

In addition, Spotify said the TV opportunity was a part of this equation — hence the recent upgrade of its Apple TV app. The more people can use Spotify across platforms, the more their usage increases, and that helps Spotify’s ads business.

The company also noted that it has given advertisers programmatic access to its audio and video inventory, though it admits that 2025 is a “transition year” for its ads business, and it doesn’t expect to see growth improve until the second half of 2026.

The streamer also announced its monthly active users increased 11% year-over-year to 713 million, and revenue was up to €4.27 billion (~$4.9 billion), beating Wall Street’s expectations. The company saw an €899 million net profit (~$1 billion) during the quarter.

However, the stock slipped after the opening bell on Tuesday, due to Wall Street’s concerns over Spotify’s mixed guidance for its fourth quarter.