The California Supreme Court ruled Thursday that Proposition 22 – the ballot measure that passed in November 2020 and classified app-based gig workers as independent contractors rather than employees – is here to stay.

The decision is a win for app-based companies like Uber, Lyft, DoorDash and Instacart, which have fought hard to maintain their business models that rely on gig workers to give passengers on-demand rides and deliver food and other goods.

“Whether drivers or couriers choose to earn just a few hours a week or more, their freedom to work when and how they want is now firmly etched into California law, putting an end to misguided attempts to force them into an employment model that they overwhelmingly do not want,” Uber said in a blog post.

While the Supreme Court’s decision can still be appealed, this ruling – at least for now – resolves a long back and forth in the courts surrounding gig worker classifications in California.

A year after 58% of California voters voted for Prop 22, a superior court judge ruled that initiative unconstitutional and therefore “unenforceable.” Judge Frank Roesch said at the time that Prop 22 limited the state legislature’s authority and ability to pass future legislation.

Thursday’s Supreme Court ruling found that, on the contrary, classifying app-based drivers as independent contractors doesn’t conflict with the California Constitution’s provision granting the Legislature authority over workers’ compensation. This upholds a California appeals court decision in March 2023 to overturn Roesch’s ruling.

Proposition 22 was Uber, Lyft, DoorDash and Instacart’s answer to Assembly Bill 5, a state law that would have required the companies to classify those workers as employees, entitling them to a minimum wage, workers’ compensation and other benefits.

Collectively, the companies spent over $200 million in advertising to convince drivers and California voters that Prop 22 was in their best interest.

Those app-based companies built entire business models on the assumption that they wouldn’t have to pay for health insurance, sick leave and other services provided to full-time employees. Their asset-light models, which rely on gig workers using their own vehicles to take passengers on rides and deliver food, are at the core of each company’s goal to keep capital expenditures low and to scale far and wide.

Prop 22 sought to find a middle ground of sorts between providing workers employment and keeping them as unsupported contractors. Per Prop 22, workers are eligible to earn 120% of state minimum wage for hours worked plus 30 cents per engaged mile, adjusted for inflation after 2021. (Uber, Lyft and DoorDash actually failed to adjust for inflation, and last year ended up having to reimburse gig workers millions for unpaid vehicle expenses.)

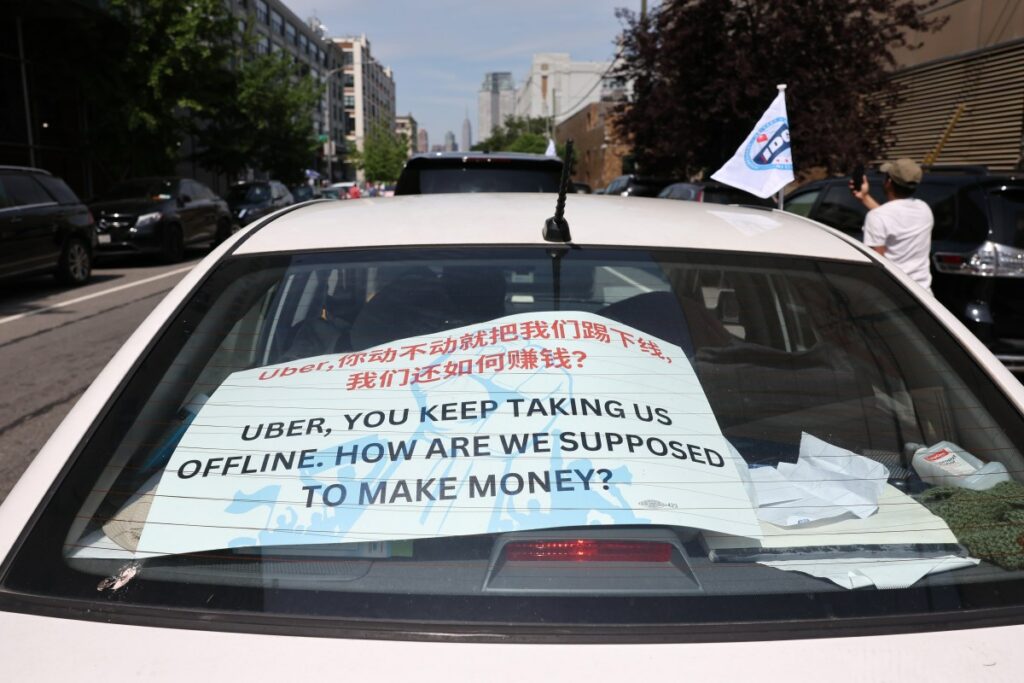

However, that so-called minimum wage only applies when a worker is actively engaged in a gig, and doesn’t reimburse drivers for time spent waiting for one. The companies rely on workers to be hanging out and ready to accept a gig so that they can maintain their reputation of offering on-demand service.

Critics have argued that the earnings guarantees fall short of actually giving drivers minimum wage after factoring in work-related expenses like car maintenance, gas and insurance.

Prop 22 also offers healthcare subsidies to drivers who work a certain number of hours per week, but drivers have told TechCrunch that it’s difficult to qualify for those subsidies. Drivers have to work 15 active hours per week for half the stipend and 25 active hours per week for the full stipend, according to Sergio Avedian, a contributor for The Rideshare Guy.

This story is developing. Check back in for updates.