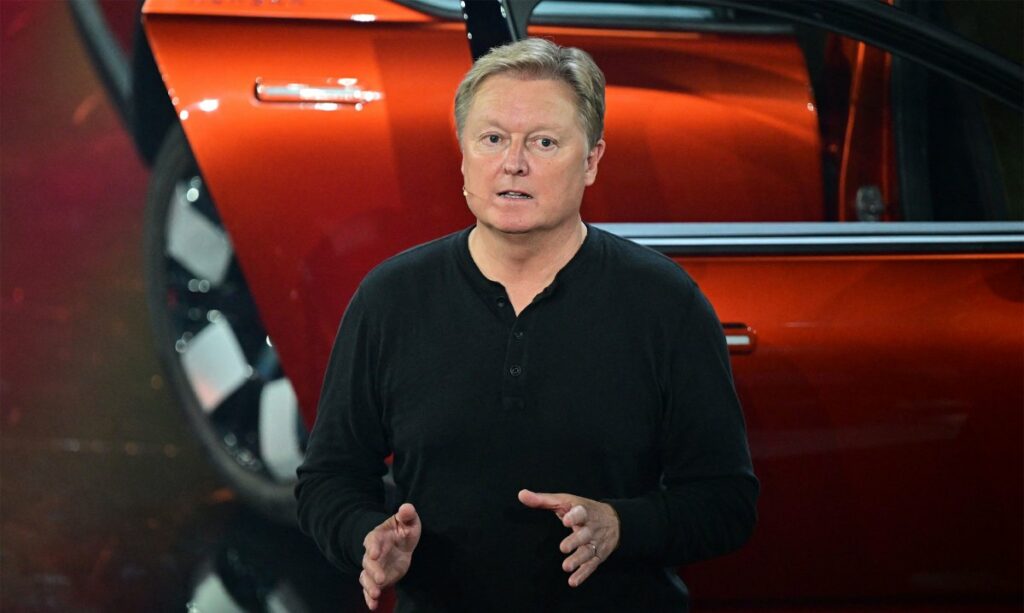

Timo Resch is basking in the sun. That’s literally true, as we spoke on a gloriously clear California day at the Quail, one of Monterey Car Week’s most prestigious events. But it’s figuratively true as well, as Resch, who took the CEO role at Porsche Cars North America (PCNA) last November, is in a very good place professionally.

PCNA just had its best quarter ever, with second-quarter sales up 13% over the same period in 2023. The brand has been showing consistent momentum of late, and it comes at a critical time, with Porsche pushing electrification in an increasingly hesitant market.

Porsche is about to launch its second EV, an all-electric version of the Macan SUV, the brand’s most affordable model. This will be followed soon after by an all-electric version of the 718, the brand’s most affordable sports car. They come hot on the heels of a new generation of 911, available as a hybrid for the first time, plus a new Panamera, which now makes even more power and range from its retooled plug-in hybrid system.

Resch, sitting between a stark white Macan Electric and a lurid purple Taycan Turbo GT, says this is “the biggest product portfolio remap that we have ever done.” The electrification drive is still there, but it’s lost some momentum of late. The company had previously planned to be 80% electric by 2030; but just last month Porsche tapped the brakes and told Reuters that goal is now “dependent on customer demand.”

Resch is pragmatic about the situation, saying the company’s primary mission is to simply give its customers what they want. “I think the market will tell us, the customers will tell us. To have options and choices available, that’s what the Porsche brand is about,” he said.

The new, battery-powered Macan will be a test of that theory, as it doesn’t replace its internal combustion predecessor, but rather complement it. “We have the Macan Electric, and for the foreseeable future, the Macan ICE (internal combustion engine),” Resch said.

At least initially, the electric and gasoline-powered Macan versions will be available simultaneously. They’ll sit side-by-side on dealership floors — each one vying for customers’ attention.

Resch declined to give any formal numbers for pre orders or hand-raisers for the Macan Electric, but he says interest is trending along regional lines. “If you look at the map, in the United States, there are states where electrification is really up and going. They have good infrastructure. There’s high demand. There’s some other states where it’s a little bit more slow,” he said.

The electric Macan is showing up first at Porsche’s two American Experience Centers, based in Los Angeles and Atlanta, where interested parties can see for themselves if the battery-electric SUV lives up to the hype.

“Our dealers and the customers are very excited to finally, finally see the car, get behind the wheel, and experience it,” Resch said.

Software woes

Resch’s emphasis on “finally” is due to the rather troubled gestation that the electric Macan suffered on the way to production. A series of software development problems delayed deployment of the all-electric SUV, built on the PPE platform, which will also underpin the upcoming Audi Q6 E-Tron.

Software has been a point of contention within the Volkswagen Group (Porsche’s parent company) for years, much of it surrounding the troubled Cariad division, which has been plagued with internal delays. Those struggles led, at least partially, to the recent $5 billion investment and joint venture with Rivian that will give VW access to the startup’s software stack.

Porsche has also been mingling its source code with Google and Apple. Where General Motors is pushing mobile device integration to the side, taking more of the user experience in-house and keeping smartphone projection options at arm’s length, Porsche is shifting toward ever-deeper mobile integration.

Resch says that Porsche will always develop its own in-car interfaces, infotainment systems that are easy to use and comprehensive in functionality. “But at the same time, if customers want to have other choices, we will get them these choices,” he said.

Turning to Apple and Google

That means future Porsche in-dash experiences featuring native Android apps while simultaneously providing an ever-deeper integration of Apple CarPlay. Soon, your iPhone will be able to reach its tendrils beyond the car’s central touchscreen, taking control even of the gauge cluster behind the wheel.

“We obviously have a proven, long relationship with Apple. We have a very good exchange about where the industry is heading. And for that reason, it’s good to align with them because we know that Apple itself is also very customer-driven, very customer-focused,” he said. “But it doesn’t mean that we are locked into anything.”

Again, Resch says it’s customer demand that’s pushing Porsche to work more closely with the Cupertino-based tech giant. “We have a rather high share of Apple users,” he said.

Apple, then, is seen as a safe partner for the brand, but there is one area where Resch isn’t keen to make alliances: Politics.

I asked Resch about the increasingly politically charged situation around EVs in the U.S. marketplace. This was the only time when the PCNA’s new CEO paused from his rapid-fire answers and took a moment to consider his answer.

In the end, he fell back to his mantra: “I think we, as a brand, we are best advised to always offer choice,” he said. “Really what is needed is more choice for customers with different variations so that they can really pick and choose. That’s what they’re used to from the automotive market before. That’s also what they’re used to from Porsche. And if you give them the choice, then they will also naturally find their way.”