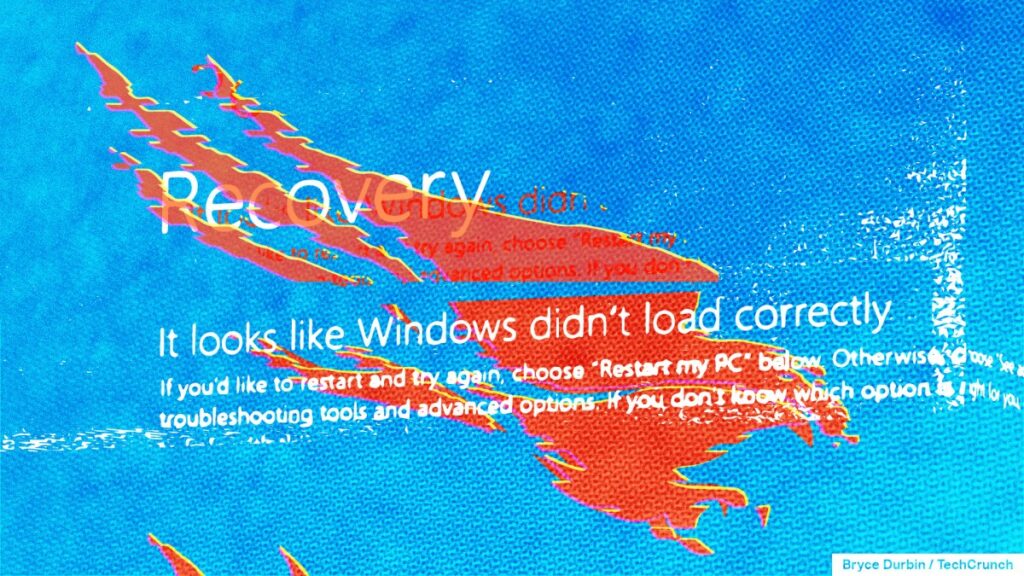

On today’s episode of Equity, Rebecca Bellan did a deep dive into the CrowdStrike outage that affected around 8.5 million Windows devices around the world, causing disruptions in air travel, banking, hospitals, media outlets, federal agencies and businesses of all kinds. The outage began when CrowdStrike, a cloud security giant, sent out a defective software update. While CrowdStrike quickly identified the issue and deployed a fix, the fallout continued over the weekend and will probably continue into this week, particularly for the travel sector. United, American and Delta airlines all collectively saw thousands of flights canceled and delayed, which will have ripple effects into the week.

On the show, Rebecca went into how this outage – despite not being a cyberattack – has provided the world with a stark example of just how vulnerable our critical infrastructure systems are, a big problem if our adversaries decide to get any bright ideas. She also discussed the reputational damage CrowdStrike experienced, the startups that have smelled blood in the water and are poised to strike, and the potential need to regulate monopolies that offer essential services.

Moving on, Rebecca took a look at what U.S. Vice President Kamala Harris’s stance on technology has been, now that President Joe Biden has stepped out of the race for the presidency and officially endorsed his right hand. Harris appears to favor oversight for big tech companies to protect consumer privacy, as well as AI regulation to stop companies from prioritizing profits over people and society. While some big names in the VC and tech world have backed former President Donald Trump due to his laissez-faire approach to regulating AI and crypto (something we talked about on last week’s Friday episode!), others in the industry have shown support for Harris. VCs like John Doerr and Ron Conway were among her early supporters, and as a presidential candidate, Harris was quickly endorsed by LinkedIn co-founder Reid Hoffman.

Rebecca also looked at a Reuters report detailing Nvidia’s plans to build a version of its new flagship AI chips for the Chinese market that are compatible with current U.S. export controls. The U.S. tightened controls of exports of semiconductors to China in 2023, a move designed to limit the Chinese military’s breakthroughs in supercomputing, but it appears Nvidia isn’t so keen to let that market go.

Finally, Rebecca took a look at a deep dive from TechCrunch’s Paul Sawers on Yandex, once referred to as the “Google of Russia” and its comeback from Nasdaq limbo. Yandex’s publicly traded Dutch entity has severed all ties with Russia, selling off the entirety of its Russian assets in a fire sale earlier this year. The “new” company has adopted the name of one of its few remaining assets, a Finnish data center and AI cloud platform called Nebuis AI. The company is now operating as something of a corporation-startup hybrid. Its goal? To be a European AI compute leader.

Equity will be back on Wednesday to interview Maven Ventures’s Sara Deshpande about why the VC is bullish on consumer funding and how venture is looking at AI companies, so tune back in then!

Equity is TechCrunch’s flagship podcast, produced by Theresa Loconsolo, and posts every Monday, Wednesday and Friday.

Subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts. You also can follow Equity on X and Threads, at @EquityPod. For the full episode transcript, for those who prefer reading over listening, check out our full archive of episodes over at Simplecast.