Scale AI, which provides data-labeling services to companies that want to train machine learning models, has raised a $1 billion Series F round from a slew of big-name institutional and corporate investors that include Amazon and Meta.

The fundraise is a mix of primary and secondary funding, and is the latest in a slew of big venture capital investments in AI. Amazon recently closed a $4 billion investment in OpenAI rival Anthropic, and the likes of Mistral AI and Perplexity are also in the process of raising more billion-dollar rounds at lofty valuations.

Before this round, Scale AI had raised around $600 million in its eight-year history, including a $325 million Series E in 2021 that valued it at around $7 billion — double the valuation of its Series D in 2020. Three years on, and despite headwinds that caused it to lay off 20% of its staff last year, Scale AI is now valued at $13.8 billion — a sign of the times, as investors scramble to get ahead in the AI gold rush.

The Series F was led by Accel, which also led the company’s Series A and participated in subsequent venture rounds.

Aside from Amazon and Meta, Scale AI has attracted an assortment of new investors: the venture arms of Cisco, Intel, AMD and ServiceNow participated, as did DFJ Growth, WCM and investor Elad Gil. Many of its existing investors also returned: Nvidia, Coatue, Y Combinator (YC), Index Ventures, Founders Fund, Tiger Global Management, Thrive Capital, Spark Capital, Greenoaks, Wellington Management, and former GitHub CEO, Nat Friedman.

Banking on the growing importance of data

Data is the lifeblood of artificial intelligence, which is why companies specializing in data management and processing are faring well right now. Just last week, Weka said it raised $140 million at a $1.6 billion post-money valuation to help companies build data pipelines for their AI applications.

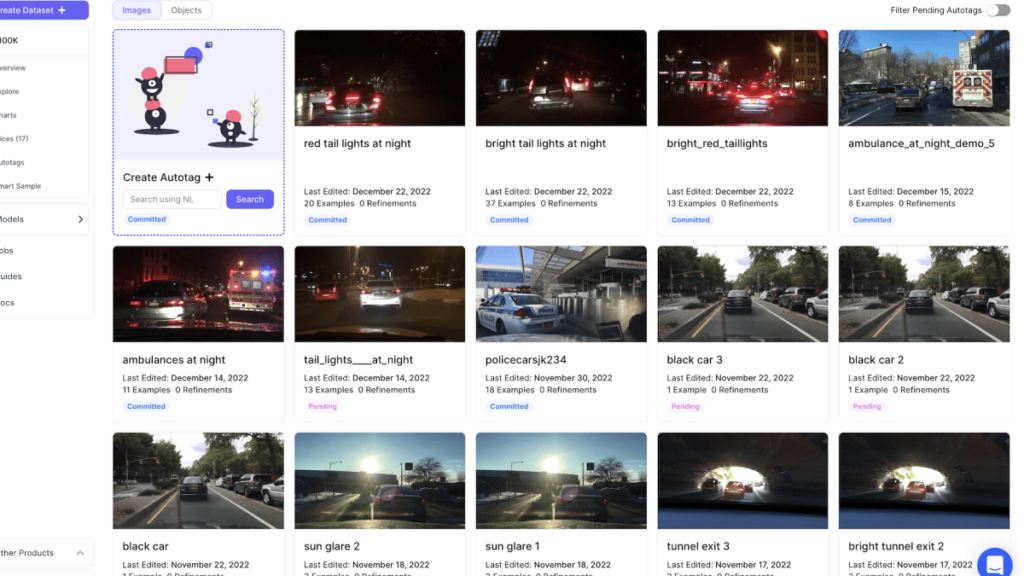

Founded in 2016, Scale AI meshes machine learning with ‘human-in-the-loop’ oversight to manage and annotate large volumes of data, which is vital for training AI systems across industries such as autonomous vehicles.

But most data is unstructured, and AI systems find it difficult to use such data off the bat. It needs to be labeled, which is a resource-intensive endeavor, especially with large data sets. Scale AI provides companies with data that has been correctly annotated and primed for training models. It also specializes for different industries with different needs — a self-driving car company will likely need labeled data from cameras and Lidar, whereas natural language processing (NLP) use-cases will need annotated text.

The company’s customers include Microsoft, Toyota, GM, Meta, the U.S. Department of Defense and, as of last August, ChatGPT-maker OpenAI, which is tapping Scale AI to let companies fine-tune its GPT-3.5 text-generating models.

Scale AI says it will use the new cash to help accelerate the “abundance of frontier data that will pave our road to artificial general intelligence.”

“Data abundance is not the default — it’s a choice,” Scale AI’s CEO and founder, Alexandr Wang, said in a press release. “It requires bringing together the best minds in engineering, operations, and AI. Our vision is one of data abundance, where we have the means of production to continue scaling frontier LLMs many more orders of magnitude. We should not be data-constrained in getting to GPT-10.”