EV warranty startup Amber is expanding nationwide, bringing on new vehicles and offering a new remote diagnostic scan — all signs that the one-year-old company is putting its recent $3.18 million seed round to good use.

The startup launched an aftermarket warranty product for Tesla vehicles called AmberCare — which is a suite of warranty plans that cover various parts of the electric drivetrain, as well as service at authorized shops — in 10 states back in March. That is now expanding to 47 states thanks to a new partnership with Lexington National Insurance Company.

The only holdouts are Alaska, Massachusetts, and EV haven California — though Amber says it expects to be live in the latter two by the end of this year. AmberCare will be available for Rivian vehicles in that same time frame, with Kia and Hyundai EVs becoming eligible in the first quarter of 2025.

Amber is also launching a VIN-specific remote diagnostic inspection product for Tesla vehicles, billing it as a sort of “telehealth” checkup option for your car. Amber will do a complimentary one of these remote inspections for any owner who applies for AmberCare, and will offer a more comprehensive version for $99.

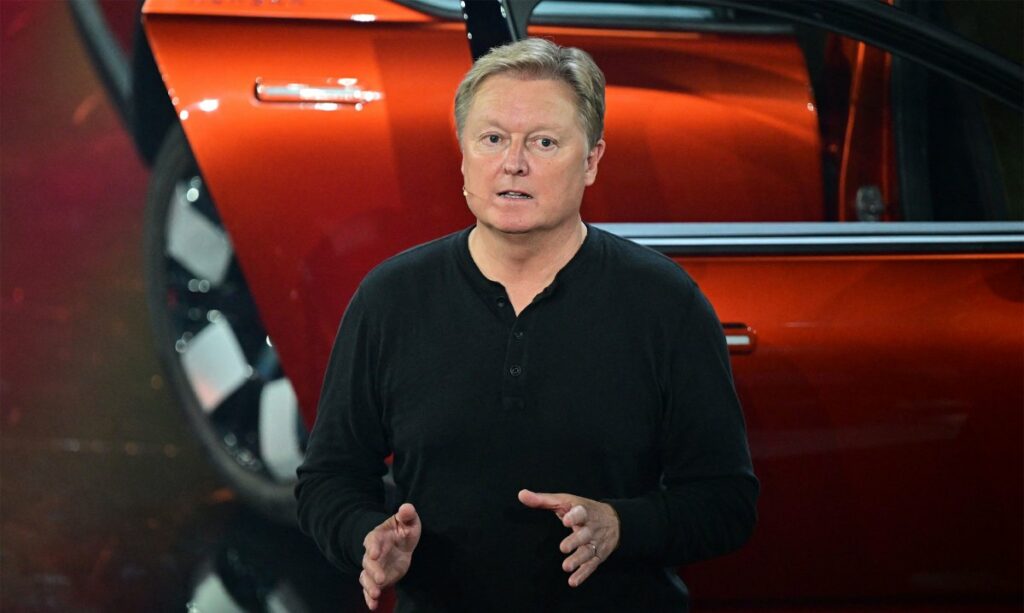

The two announcements represent a step up for Amber, which consists of just six employees and is about to acquire its 100th customer, according to CEO and founder Joe Pak.

“I will admit that in the beginning there has been healthy skepticism. It’s a new insurance or quasi-insurance offering that we’re reaching customers with,” he told TechCrunch on a video call. “But, you know, like one customer after another, and one great review after another, we’ve been scaling.”

Pak said this steady growth is helping Amber prepare for when it is finally able to launch in California, which requires non-automotive dealers selling aftermarket warranties to register those as insurance products. That could be a big moment for Amber, since the state has about half of its addressable market in the U.S.

Pak told TechCrunch in March that the company’s approach to customer acquisition was going to be to meet Tesla owners where they are — in other words, online. That has gone well enough that non-customers have started calling up Amber looking for help with problems.

“People actually love that there’s a phone number to call when something breaks because it’s impossible to reach Tesla support,” he said.

When those non-customers and customers alike make a call, Amber will now have its new remote diagnostic inspection product to offer alongside AmberCare. This involves tapping into Tesla’s diagnostics toolkit, which gives access to firmware codes and alerts, and even information coming from the car’s battery management software. It allows Amber to see warnings signs of impending trouble, up to something as serious as if the car’s battery is about to fail.

Amber gets access to at least seven days worth of data from the car, and customers can revoke that access at any point after. The company also has access to a pilot version of Tesla’s fleet API, which officially launched late last year, that lets Amber pull more detailed data — like odometer readings — to get a more comprehensive look at the health of the vehicle.

Pak said the “magic” of what Amber does with this new offering is being able to interpret all this data. That’s why one of the company’s six employees is a senior remote diagnostic technician who spent 10 years at Tesla, and another who spent 10 years as one of Tesla’s service advisors.

Pulling all this information is not just crucial for Amber’s ability to compile vehicle reports for customers. It also might help open up new lines of business.

Pak said that fleet owners and dealers have expressed interest in working with Amber to develop a pre-certified program based on the information the startup can remotely pull off of the cars. That could be a boon to Amber’s bottom line, and also solve one of the trickier headaches of buying a used EV, which is that dealers can be coy or outright tight-lipped about the vehicle’s battery health.

Pak said he appreciates Tesla formalizing its approach to this kind of fleet data, even if it inevitably charges for access, because he used to lead the developer ecosystem and API teams at Samsara, which bundles up data from internet-connected devices installed on fleet vehicles. “I think it’s a great sign,” he said. “There are a lot of asks of you from all these [other companies], and being able to deliver uptime and the right products — it can be really tricky.”