Two years ago, an employee at Fisker Inc. told me that the most pressing concern inside the EV startup was not whether its Ocean SUV would get built. Fisker was outsourcing the manufacturing of its first EV to highly respected automotive supplier Magna, after all. The startup’s November 2022 start-of-production target was aggressive, but not impossible for a company like Magna, which builds vehicles for the likes of BMW.

Instead, this person said, employees were increasingly worried that Fisker wouldn’t be ready to handle all the problems that come after a company puts a car on the road. They were worried the focus was all on building the car and not the company.

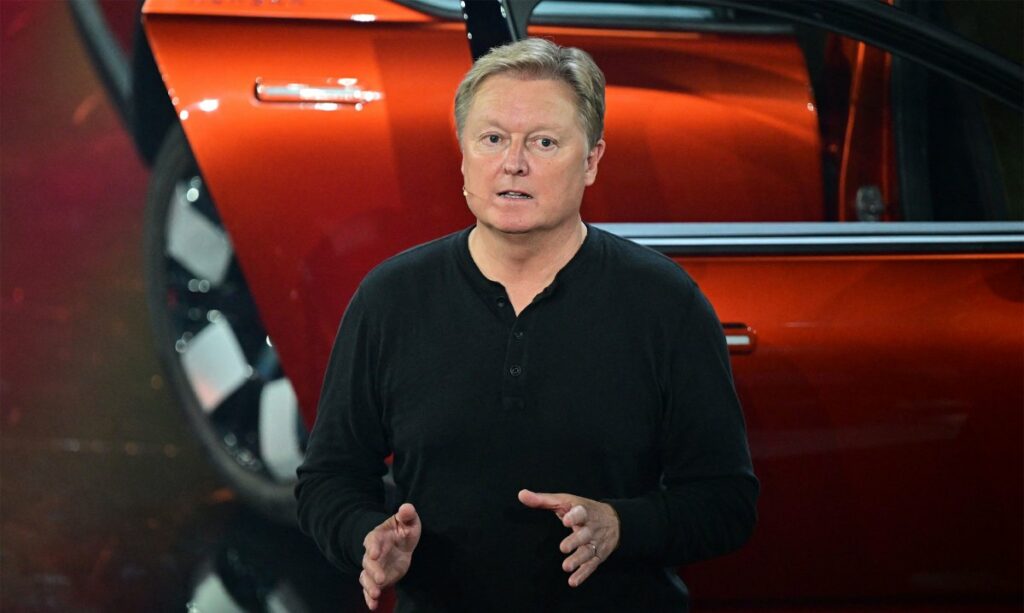

The conversation stuck with me because Fisker founder and CEO Henrik Fisker had an automotive startup fail a decade ago for, arguably, this reason. That company, Fisker Automotive, got a hybrid sports car into the hands of a few thousand customers. But the company buckled soon after as it faced complaints about quality, the failure of its battery supplier, and a hurricane that literally sunk a ship full of vehicles.

The employee’s warning that the new Fisker was heading down a similar path was striking and ultimately prescient. Fisker filed for Chapter 11 bankruptcy protection this week after spending only just one year shipping its SUV to customers around the world. In large part, its undoing is directly tied to its inability to address the worries that employee raised in 2022.

This person wasn’t alone. Dozens of others who worked at Fisker have echoed this sentiment to me in conversations since, nearly all of them on the condition of anonymity because they feared losing their jobs or retaliation from the company. Those conversations informed stories I reported on the Ocean’s quality and service problems, Fisker’s internal chaos, and decisions from Henrik Fisker and his co-founder, wife, CFO and COO, Geeta Gupta-Fisker, that dragged the company down.

Most all of them told me about how the lack of preparedness ran deep and permeated almost every division of the company, as I’ve previously reported for TechCrunch and Bloomberg News.

The software powering the Ocean SUV was underbaked. It contributed to the delay of the launch of the SUV, and it even kneecapped the very first delivery in May 2023, which Fisker had to turn around and troubleshoot shortly after handing it over. A similar thing happened when the company made its first deliveries in the U.S. in June 2023, when one of its board members’ SUVs lost power shortly after taking delivery.

The company shipped far fewer Ocean SUVs than it originally projected. Even after it lowered its target for 2023 multiple times, it still struggled to hit its internal sales goals. Sales employees have recounted stories of calling potential customers repeatedly in hopes of selling vehicles because so few new leads were coming in. Others wound up pitching in to sell cars even if they worked in completely different departments.

Many customers who did take delivery of their Ocean ran into problems like sudden power loss, trouble with the braking system, glitchy key fobs and problematic door handles that could temporarily lock them in or out of the car, and buggy software. (The National Highway Traffic Safety Administration has opened four investigations into the Ocean.)

Fisker struggled with the quality of some of its suppliers, and employees have said it did not build out a proper buffer of spare parts. This put extra pressure on the people in charge of trying to fix the cars as they ran into problems, and ultimately led to the company plucking parts from not only Magna’s production line in Austria, and even from Henrik Fisker’s own car. (Fisker has denied these claims.)

This whole time, lower- and mid-level employees went to great lengths to do what they could to help out the slow-growing customer base. One owner told me an employee took a phone call on their personal cell phone while at a funeral. Other employees relayed stories of workers doing company business while at the hospital. Many worked long days, nights and weekends — to the point that at least one hourly employee has filed a prospective class action over this very issue.

The company itself admitted on multiple occasions that it did not have enough staff to handle the influx of customer service requests. This was another place where workers from other departments pitched in. Some are even still fieling customer calls today, despite having left Fisker weeks or months ago.

Fisker struggled at the mundane-yet-serious work of being a public company, too. It lost track of around $16 million in customer payments at one point, thanks to messy internal accounting practices. It suffered multiple delays in its required reporting to the Securities and Exchange Commission. One of those delays allowed one of the company’s largest lenders to eventually take the reins in the final months.

Despite all this, Fisker is still touting its speed to market as an accomplishment as it begins the bankruptcy process. “Fisker has made incredible progress since our founding, bringing the Ocean SUV to market twice as fast as expected in the auto industry,” a nameless spokesperson said in a press release about the Chapter 11 filing.

This ephemeral corporate representative goes on to say that Fisker “faced various market and macroeconomic headwinds that have impacted our ability to operate efficiently.” While that is certainly true to an extent, there is otherwise no introspection about the myriad issues that got the company to this moment in time.

Perhaps that will surface in the Chapter 11 proceedings, where the company looks to to settle its debts (of which it claims to owe between $100 million and $500 million) and offload or otherwise restructure its assets (totaling between $500 million to $1 billion).

What happens next will depend on how those proceedings go. Fisker always took an “asset-light” approach, likening itself to how Apple leveraged Foxconn to help build the iPhone into a global phenomenon. The problem with being asset-light is that it naturally means there is less to borrow against or sell when things break bad.

Magna has stopped production of the Ocean and expects a $400 million revenue loss this year as a result. It’s unclear how much progress was Fisker made on its future products, the sub-$30,000 Pear EV and the Alaska pickup. The engineering firm that was co-developing these vehicles with Fisker recently sued the startup, calling the projects into question.

Fisker said in its press release that it will continue “reduced operations,” including “preserving customer programs, and compensating needed vendors on a go-forward basis.” In other words, it will continue to manage a bare-bones operation in case there is a willing buyer of the assets it’s putting up for sale in the Chapter 11 case.

A decade ago, the bankrupt Fisker Automotive did find a buyer. It ultimately morphed into a startup known as Karma Automotive, which is still nominally around today. There have been similar outcomes lately. Three other EV startups that recently filed for bankruptcy — Lordstown Motors, Arrival and Electric Last Mile Solutions — were able to sell off assets to peer companies in the space.

But the ultimate fate of this startup, and its assets, won’t change the fundamental problem: Fisker wasn’t ready to grapple with bringing a flawed car to market.