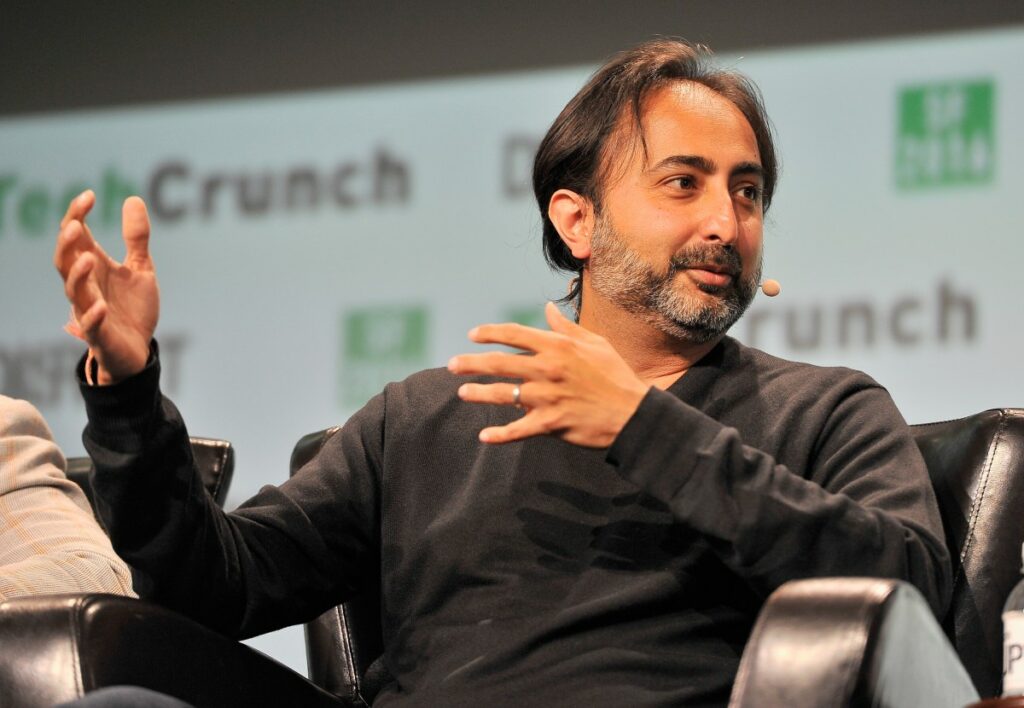

In this episode of the StrictlyVC Download, Connie Loizos and Alex Gove spoke with Pranav Singhvi and Hemant Taneja of General catalyst, which is one of the biggest venture firms on the planet. They discussed a product that general catalyst created some five years ago, and that was reminiscent of GE leasing. Listen to the full episode for more details but basically, the firm extends capital to companies, both private and public, that spend a lot of money on customer acquisition and marketing each growth basically trying to sort of separate that expense from the rest of their expenses. What they ask for in exchange is a percentage of the income that’s generated from those new customers. And it kind of packages these deals together by trying to anticipate how much a company will grow over several years.

What is fascinating about general catalyst is just how little it looks like a venture firm in 2024 You could, of course, say the same thing about many of the biggest venture firms out there, including Andreessen Horowitz. It’s probably not a coincidence that they are all registered investment advisors now. But General Catalyst was founded just 24 years ago in 2000 and it has grown and grown, and now it has something like $25 billion in assets under management. In addition to this financing product, for example, some of you might know that it has acquired a couple of smaller venture firms over the last 12 or so months. It’s also in the process of buying a small health care system in Ohio—You don’t hear that every day.

They also discussed, missing out on OpenAI; whether the two think more privately held companies might just stay private forever; and about a financing product they offer to both private and public companies that spend a boatload on customer acquisition and marketing. Listen to the full episode for more.