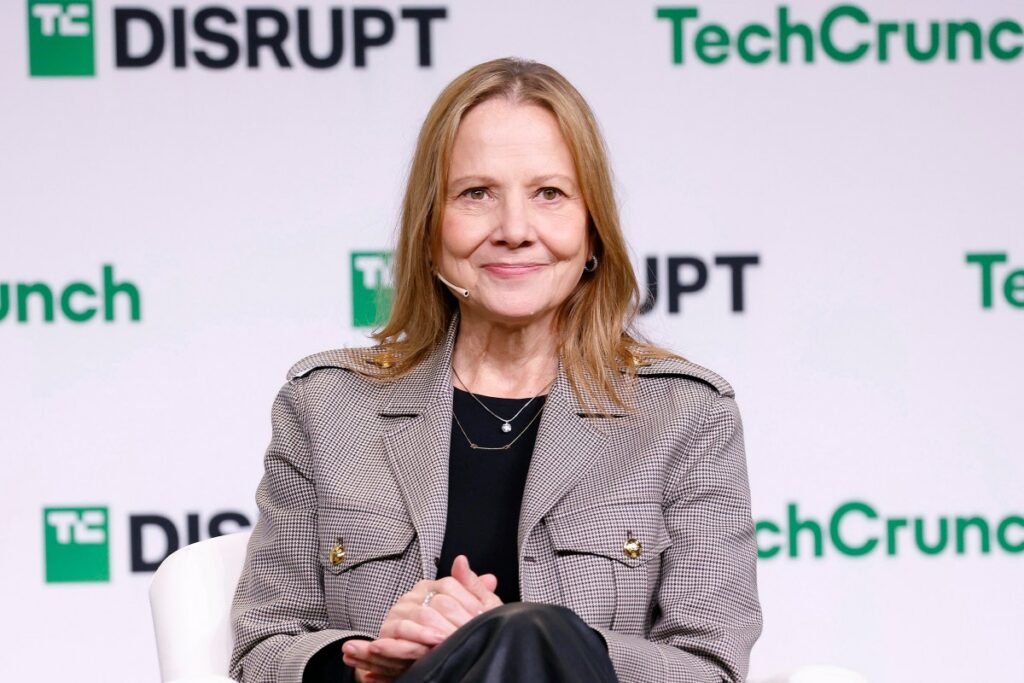

General Motors expects to save up to $1 billion annually by ending its Cruise robotaxi development program, CEO and Chair Mary Barra said Tuesday during the company’s earnings call.

The estimate comes nearly two months after the automaker said it would no longer fund Cruise, its self-driving subsidiary that aimed to commercialize robotaxis. “GM has proposed a restructuring plan that will refocus our autonomous driving strategy on personal vehicles,” Barra said, adding the company expects to see a run rate savings of about $1 billion on an annualized basis by ending robotaxi development

CFO Paul Jacobson said those projected cost savings are “based on our assumption that Cruise employees will be fully integrated into GM by mid-year.”

“We believe our refocused autonomous driving strategy will lead to efficiencies and a $1 billion annual run rate savings in our investment relative to the $1.7 billion we spent on Cruise in 2024,” he said.

GM reported Tuesday a $2.9 billion loss for the fourth quarter of 2024, results driven by charges related to ending robotaxi development as well as costs associated with restructuring its China operations. The company took a $500 million one-time charge related to its decision to stop funding Cruise. It also reported a $4 billion non-cash restructuring charge and impairment of interests related to its China business.

Despite those fourth-quarter hits, GM’s full-year results — particularly on a pretax, adjusted basis — were rosier. The company reported net income of $6 billion for the year; on an adjusted basis, its annual profit was $14.9 billion.

Cruise expenses, excluding the special items for the restructuring charge, were $400 million in the quarter, down from $800 million in 2023.

Cruise employees were blindsided by GM’s decision to pull back from the company, which the automaker had invested close to $10 billion in since 2016. Following the announcement in December, most of those employees have all but stopped working as they wait to hear if they will be among those who get laid off or those who get retention offers to join GM and work on autonomy there, according to two employees who spoke to TechCrunch on condition of anonymity.

GM offers customers Super Cruise, an advanced driver assistance system that can perform some automated driving tasks such as hands-free driving on certain highways. The automaker has been working to roll out a hands-free, eyes-off version of the technology, and may rely on Cruise self-driving technology to beef out Super Cruise’s capabilities.

“We want to be leaders in Level 4 autonomy, and we think we’re going to continue to evaluate the landscape to do that as capital efficiently as possible,” Barra said, noting that GM is open to working with strategic partners.

Level 4 automated systems can drive themselves without requiring a human to take over in certain conditions.

In mid-January, Cruise management began extending retention offers to employees, almost all of whom were engineers, according to sources familiar with the matter.

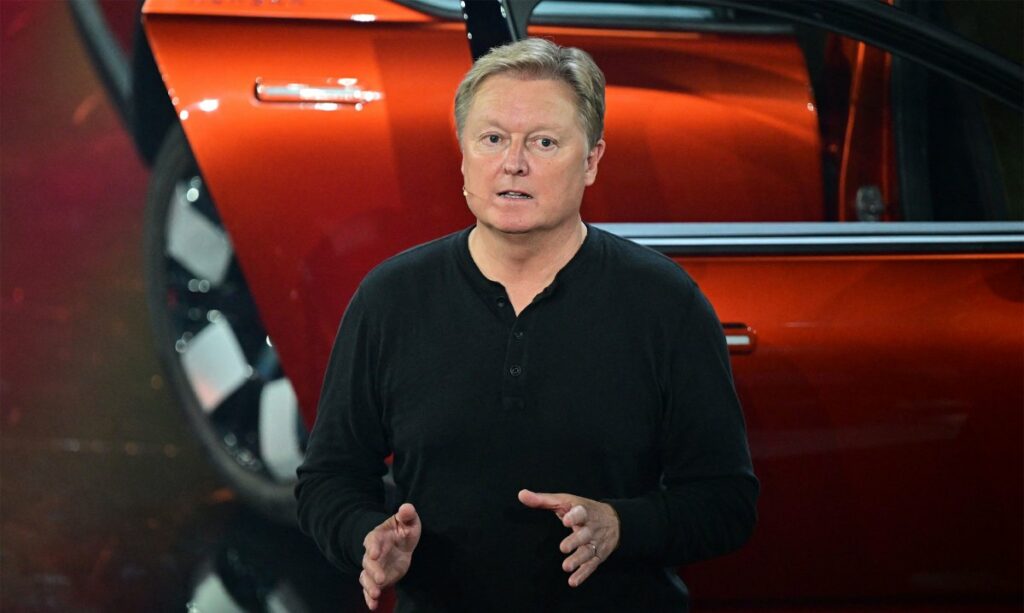

In an email sent to Cruise staff on January 16, CEO Marc Whitten asked for continued patience as senior leadership worked out what the next steps would be and waited for the Cruise board to make a call.

“While our plans remain subject to Cruise board approval, I wanted to share that we completed our first wave of notifications to those employees whose roles we expect to need as part of the go-forward Cruise,” Whitten said in the email, which TechCrunch has viewed.

Whitten also said the company will continue to evaluate the rest of the team, and noted that those who haven’t yet received a notification aren’t necessarily at risk of losing their jobs.

Sources at Cruise told TechCrunch the board should be meeting in early February, at which time they’ll hopefully come up with a plan for the thousands of now-idle and worried workers. That said, Barra said during Tuesday’s earnings call she expects to finalize the Cruise restructuring plan “later this quarter.”

Jacobson noted Tuesday the expenditures for Cruise employees in GM’s North America segment will be included in the company’s financials later this year. He warned those expenditures will impact GM’s North America margin “by around 50 basis points this year,” though he expects GM will remain “within our 8 to 10% range.”

“It will also increase our auto fixed costs and reduce our adjusted automotive cash flow, as the cash used by Cruise was excluded previously,” Jacobson said.