For decades, couples going through in vitro fertilization have had to spend tens of thousands of dollars on the procedures with no guarantee of success.

It’s not only an emotionally draining process, but a financially exhausting one as well.

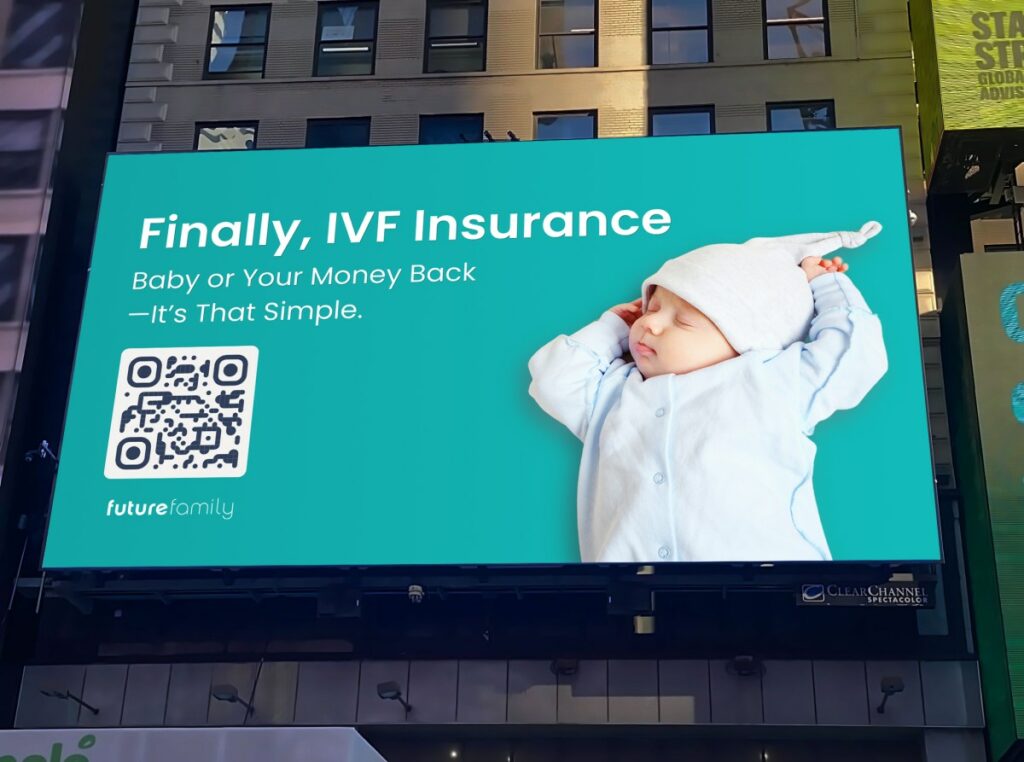

San Francisco-based startup Future Family wants to help ease some of that burden for couples with a new IVF insurance product in the United States. Built with one of its investors, global reinsurer MunichRe, the new offering essentially offers a money-back guarantee to those going through IVF.

CEO and co-founder Claire Tomkins likens it to trip insurance. A couple pays 20% insurance upfront before starting an IVF cycle. If they don’t have a baby after two cycles or lose the baby within two weeks of birth, they can file a claim to be reimbursed.

The cost of two IVF cycles can reach $40,000, depending on location. With Orange Shield, Future Family’s new product, the average cost of protection is $3,000 down and $999/month for five months. If treatment doesn’t succeed after two rounds, families can get a refund under their IVF insurance policy.

Orange Shield is available at participating clinics nationwide. Families can pay either via monthly installments or with lump sum payments. Overall, the policy covers all IVF-related expenses up to the selected coverage limit, with a maximum of $50,000. All eligible treatment costs can be included.

“Our goal is simple: to help build more families by making IVF successful, easy to afford, and less stressful,” said Tomkins, herself a mother to three children born through IVF. “IVF Insurance works like other types of insurance—similar to auto insurance, where you purchase coverage hoping you won’t need to file a claim.”

Eligibility criteria is based on a range of underwriting factors, including age and medical history, she said. And patients aged 38 years or older who plan to use their own eggs are not currently eligible for coverage. However, patients 38 and older can qualify for coverage if using donor eggs. Other eligibility factors include lifestyle habits such as tobacco use, intended egg/sperm sources, and infertility history.

Since its 2016 inception, Future Family says it has worked with over 10,000 families to help them navigate the IVF process with a variety of offerings including fertility financing for IVF and egg freezing, and one-on-one coaching. It says it also has distributed $200 million in credit.

In total over the years, Future Family – a Startup Battlefield company – has secured $150 million in total funding, including $100 million in a credit facility announced in 2018. Investors include Munich Re Ventures – the venture capital arm of MunichRe, TriVentures, MS&AD Ventures, ORIX, Aspect Ventures, Mindset Ventures, at.inc/ and OurCrowd. Its last raise was a $25 million Series B announced in April of 2022.

In vitro fertilization is an area long tackled by startups. More recently, a new fertility wellness company, Lushi, emerged with $5 million in funding.