Monarch Tractor has laid off around 10% of its workforce as part of a restructuring that will see it prioritize non-agricultural customers, license its autonomous technology, and boost sales of its AI-powered farm management software, TechCrunch has learned.

Around 35 employees were cut this week by the Livermore, California-based autonomous electric tractor startup that has raised a total of $220 million since it was founded in 2018. Some Monarch workers told TechCrunch they were let go without severance. It’s the second cut this year; Monarch previously laid off around 15% of its workforce in July.

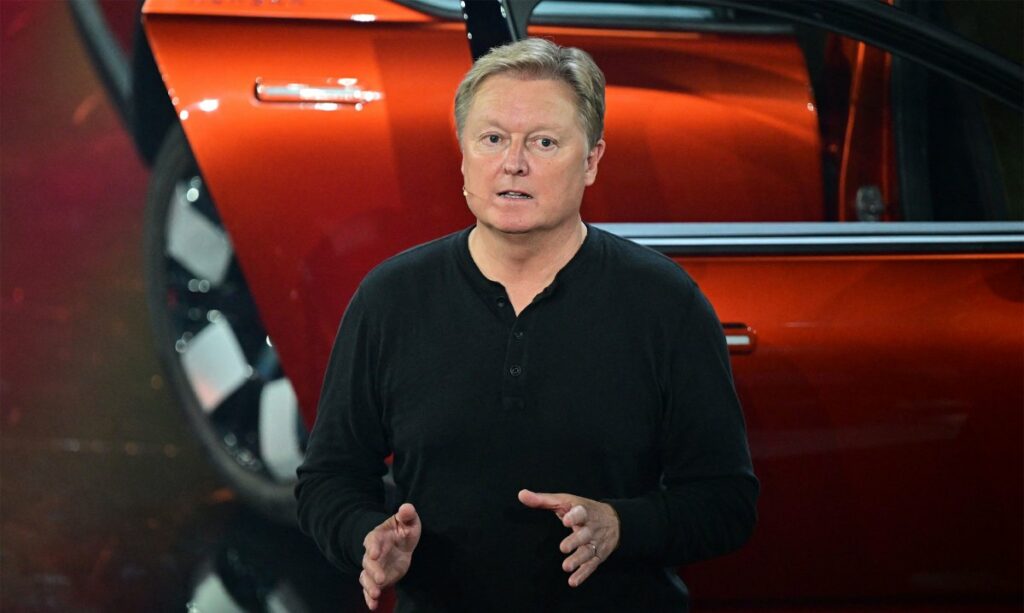

CEO Praveen Penmesta told TechCrunch in an interview the company decided to restructure after a slower-than-expected third quarter, and despite raising $133 million in July from the likes of Foxconn and agri-food tech impact firm Astanor. Penmesta said he was uncertain if employees were let go without severance, but that the company has been trying to help out laid off workers on a case-by-case basis.

“All of this happened pretty quickly,” Penmesta said, referring to the recent crash of California’s vineyards, which made up a bulk of Monarch’s early customers. That development, plus an ongoing pullback in agri-tech investing, left Penmesta and his team looking at other options.

“The industry has slowed down on acquisition of new equipment and new solutions, especially in the core farming sectors,” Penmesta said. “But in the meantime, as a platform company, we also have some very exciting non-agriculture opportunities that started sprouting because of our success in Ag.”

He said the company, which has shipped 500 tractors to date, is now focused on widening its customer base in a number of ways. It is expanding beyond agricultural customers to golf courses, solar farms, and even municipalities. It’s also putting more focus on selling its “WingspanAI” farm management software. And Monarch is in talks with other “off-road” vehicle companies to license its autonomous technology.

Penmesta said these changes inspired the cuts which hit, among other things, some of Monarch’s engineering and operations team. He also said that Monarch is leaning more on contract-manufacturer Foxconn, which builds the tractors at its Lordstown, Ohio facility, for operational roles.

“We are a startup,” Penmesta said. “You have to be agile, right?”