Nearly seven years after announcing its first fund, Sapphire Sport—the venture fund focused on sports, media, and entertainment—is spinning out from Sapphire Ventures. The fund will rebrand as an independent venture firm, 359 Capital.

The firm’s new name is a tribute to the sub-four-minute mile, a feat once deemed humanly impossible but ultimately achieved through rigorous dedication and perseverance. Spirito said that the name reflects the firm’s core principle of helping its portfolio founders achieve the impossible.

The separation from Sapphire Ventures, an investment firm with about $11 billion in assets under management, was always on “the vision board,” said Michael Spirito, managing partner and co-founder of 359 Capital. “We’re all grown up and ready to leave home.”

Sapphire Sport, which is currently halfway through investing its second fund of $181 million, has always maintained a separate group of limited partners from Sapphire Ventures. Its LPs are all deeply tied to the sports industry, including major names like City Football Group, adidas, AEG, Madison Square Garden, Sinclair, and dozens of team owners.

“When we started in 2019, the name Sapphire Sport wasn’t just alliterative and sounded cool,” Spirito said. “Sport captured the LP group.”

Seven years later, the sports-focused LPs still leverage their relationship with the firm to gain insights into emerging tech companies across the media and sports landscape, Spirito said.

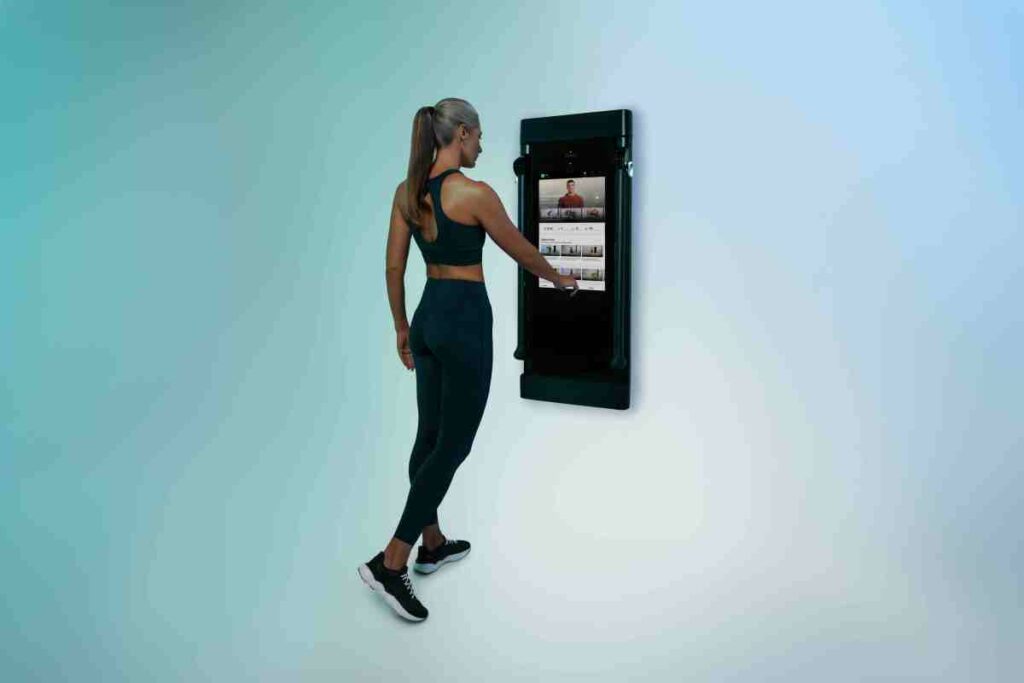

Some of the startups 359 Capital has backed include Beehiiv, a creator-focused newsletter; an online casino; Betty Labs, a sports media platform; Overtime, an AI search engine; Perplexity, a successful AI browser; and Tonal, a home gym system.

Techcrunch event

San Francisco

|

October 13-15, 2026

The firm’s entire portfolio of 30 companies and all of its investment staff will move over to 359 Capital. The transitioning staff includes Spirito, co-founders of Sapphire Ventures, David Hartwig and Doug Higgins, and newly promoted partner Rico Mallozzi.

As 359 Capital, the firm will continue to focus primarily on Series A and Series B startups, writing checks between $2 million to $10 million. The firm will continue to invest from its second fund through the first half of 2027, Spirito said.

359 Capital will have high-profile competition in the world of sports-focused venture capital. Courtside Ventures, backed by Shaquille O’Neal and Michael Jordan, is in the process of raising a fourth fund of $100 million, according to an SEC filing.