Welcome back to TechCrunch Mobility, your central hub for news and insights on the future of transportation. To get this in your inbox, sign up here for free — just click TechCrunch Mobility!

Ford made its big EV announcement early this week — a plan to invest $2 billion to transform its Louisville Assembly Plant into a factory capable of making a new generation of affordable EVs, starting with a midsize pickup truck with a base price of $30,000 that is slated to launch in 2027.

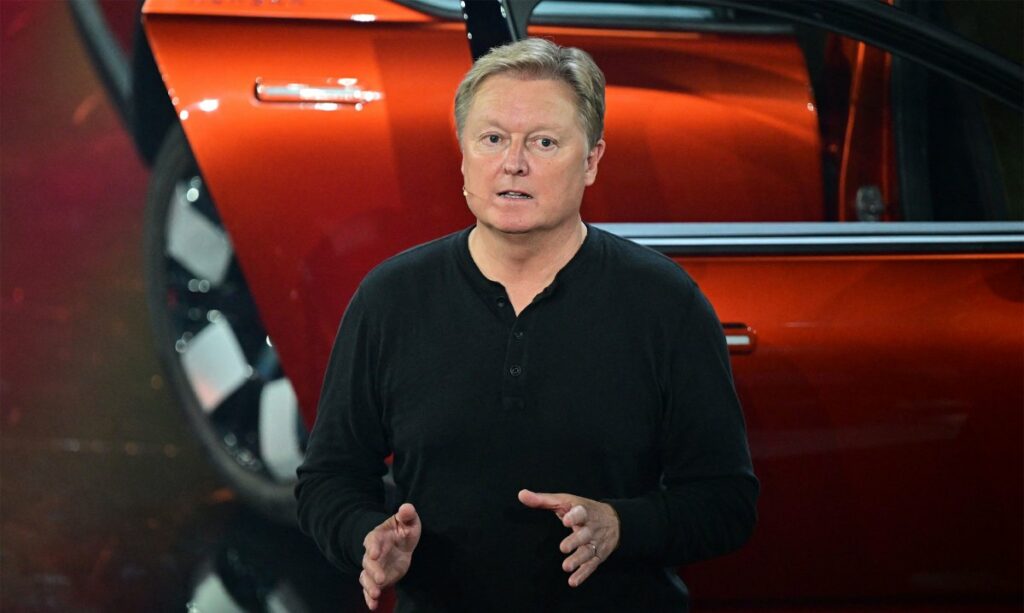

Amid the presentations from various executives, union leaders, and employees, CEO Jim Farley said something I couldn’t quite shake:

“There are no guarantees with this project. We’re doing so many new things, I can’t tell you with 100% uncertainty that this will all go just right; it is a bet. There is risk.”

The bet? The company put together a skunkworks team, which worked for a couple of years to find a way to build a line of affordable electric vehicles that could be made in the United States faster, more efficiently, and with fewer parts, all while preserving profit margins. To do that, the company has scrapped the century-old system that made Ford a household name and developed a new three-pronged assembly line that uses more automation and unicastings.

Ford, like many other automakers, is being squeezed by tariffs, slower than expected EV demand, and the looming threat of competition from China. The company has to act if it wants to stay relevant. But is this the move?

Ford can’t really use this manufacturing technique at other factories, since it is pinned to how the vehicle is designed and then split into three unicastings — a major departure from the method used to assemble its other vehicles. What this means is we’re witnessing a $5 billion experiment ($3 billion for the LFP battery factory and $2 billion for Louisville) to keep jobs in the United States.

Techcrunch event

San Francisco

|

October 27-29, 2025

A little bird

A few little birds told us that rental car startup Kyte, which once billed itself as the “best alternative to Hertz,” is no longer operating.

The startup was already in trouble late last year after slashing staff and cutting down to just two markets. But in July, the company sold its customer list to peer-to-peer car share company Turo. (Turo declined further commenting on the terms.) And since then, Kyte appears to have gone fully under, entering a form of receivership in California in late July.

That has apparently left a number of customers in the lurch who had already booked rentals through Kyte; Turo told TechCrunch it is only responsible for the assets it purchased — not any financial claims against the now-defunct Kyte.

Got a tip for us? Email Kirsten Korosec at [email protected] or my Signal at kkorosec.07, or Sean O’Kane at [email protected].

Deals!

Bumper, a U.K.-based buy now, pay later platform for car servicing and repairs, raised $10.8 million in a Series B extension funding led by Autotech Ventures. InMotion Ventures, Suzuki Global Ventures, Porsche Ventures, and Shell Ventures also joined.

Chowdeck, a Lagos-based food delivery startup, raised $9 million in Series A funding led by Novastar Ventures, with participation from Y Combinator, AAIC Investment, Rebel Fund, GFR Fund, Kaleo, HoaQ, and others.

Eve Air Mobility — the urban air mobility company, announced a $230 million capital raise and dual listing in the U.S. and Brazil. The company has raised $1 billion to date.

Ultraviolette, the Indian electric motorcycle startup, raised $21 million in an all-equity round led by the corporate venture arm of Japanese electronics giant TDK Corporation. Ultraviolette’s existing investors Zoho Corporation and Lingotto (previously Exor Capital) also participated.

Via has filed its S-1 paperwork on its road to IPO. The transit software company has not yet determined the number of shares to be offered or the price range. This dropped just as I was sending out this newsletter, so I haven’t read through the entire doc yet. A couple of items worth noting, though: The company’s revenue grew 35% to $337 million from 2023 to 2024. Its net loss narrowed to $90 million over the same time period. And CEO Daniel Ramot’s 2024 compensation package, which includes stock grants, is $9.5 million. Per the footnotes, the company is issuing him an additional grant package for 2025 and a cash bonus program.

WeRide, the Chinese autonomous vehicle company, has secured an investment from Grab. The companies did not disclose the investment amount. WeRide said the funds will help speed deployment and commercialization of Level 4 robotaxis and shuttles in Southeast Asia.

Notable reads and other tidbits

Foxconn will no longer build electric tractors for California startup Monarch Tractor after the Taiwanese tech giant recently sold its Ohio factory to SoftBank. History lesson: Foxconn had planned to establish an electric vehicle contract manufacturing operation at the factory and Monarch was one of four companies it was working with. The other three (Lordstown Motors, Fisker, and IndiEV) have all gone bankrupt.

Some high-profile executive shuffling is underway. Self-driving truck maker Waabi hired Uber Freight CEO Lior Ron (who has a long and interesting history in the AV world) as chief operating officer. Rebecca Tinucci, who previously spent six years building Tesla’s charging network, has taken over as head of Uber Freight. Ron will stay on as Uber Freight’s chairman.

A spending freeze on the National Electric Vehicle Infrastructure program has thawed after months of uncertainty. The Trump administration has finally issued new guidance that states can use to dole out $5 billion in funding for electric vehicle charging infrastructure, after spending months withholding the money.

Rapido, a popular ride-hailing platform in India, is beta-testing its food delivery service in Bengaluru in a challenge to market leaders Swiggy and Zomato.

How many pivots can one company make in its lifetime? Revel is testing the bounds of that question. The company, which started out as an electric scooter rental service, has shut down its ride-hailing service in New York City. Revel will instead focus on its nascent EV charging business.

A bit more on the “Tesla Dojo is dead” news that I wrote about last week. Elon Musk confirmed that Tesla has disbanded the team working on its Dojo AI training supercomputer, just weeks after announcing he expected to have Tesla’s second cluster operating “at scale” in 2026. Tesla is shifting its focus to its AI5 and AI6 chips, which are being manufactured by TSMC and Samsung, respectively. Note: Tesla’s plant in Buffalo, New York, was supposed to be the home of the Dojo supercomputer and the company had committed to investing $500 million into the factory over five years to bring Dojo there.

Riding in a Waymo robotaxi is a modern, even futuristic, experience for customers. With one exception: the music. Reporter Max Zeff wrote about why Waymo’s music upgrade matters.

One more thing …

The Autonocast, the other podcast I co-host (I’m also on TechCrunch Equity) that is focused on the future of transportation, had another episode that I think you’ll be keen to listen to. This time, we interview Nuro co-founder and president Dave Ferguson.