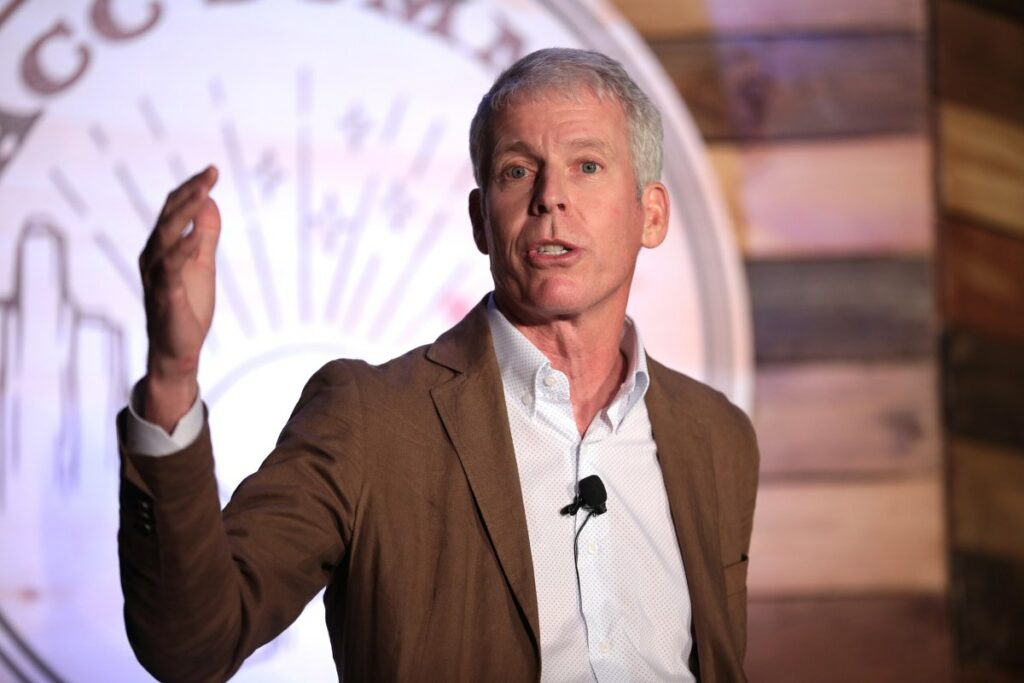

President-elect Donald Trump said on Saturday that he would be nominating Chris Wright, CEO of oilfield services company Liberty Resources, to the post of energy secretary.

Wright has been a big booster of oil and gas. From his perch at Liberty, Wright last year denied that there’s a climate crisis or that it’ll result in negative impacts, something that puts him at odds with the majority of atmospheric and climate scientists, or that the world is undergoing an energy transition. He claimed that energy prices are up as a result of policies favorable to clean energy, despite the fact that oil prices have been flat since 2010 and natural gas prices are down 50%, too.

At the same time, Wright acknowledged that the climate is changing and the seas are rising. He’s also no stranger to climate tech.

Liberty invested in Fervo Energy, an advanced geothermal startup, in 2022, participating in a $138 million round. Fervo builds on fracking technology originally developed to drill oil and gas wells to drive down the costs of geothermal power.

Wright also sits on the board of Oklo, a nuclear power startup chaired by Sam Altman. Oklo went public via SPAC in 2023, and while it’s had trouble getting its reactor designs certified by the Nuclear Regulatory Commission, its share price has doubled in the last month as investors have ridden the energy-for-datacenters wave.

If confirmed by the Senate, Wright would oversee the Department of Energy’s sweeping portfolio, from nuclear weapons testing to national labs, emergency petroleum reserves to energy efficiency programs.

He would also oversee the Loan Programs Office, which offers loan guarantees for large energy-related infrastructure projects. While most earlier stage startups wouldn’t be directly affected by any change in the LPO, debt offered through the program is something like a light at the end of the tunnel, providing helpful support as they go to raise from private lenders to deploy their technologies at commercial scale.

The LPO currently holds about $35 billion in its portfolio, most of which fall under the climate tech umbrella, including utility-scale solar projects, wind farms, and carbon capture installations.