After seeing double-digit growth in South Korea, Uber Technologies has announced a strategic plan to double down in the country — directly challenging market leader Kakao Mobility, the ride-hailing unit majority-owned South Korean messaging and tech giant Kakao.

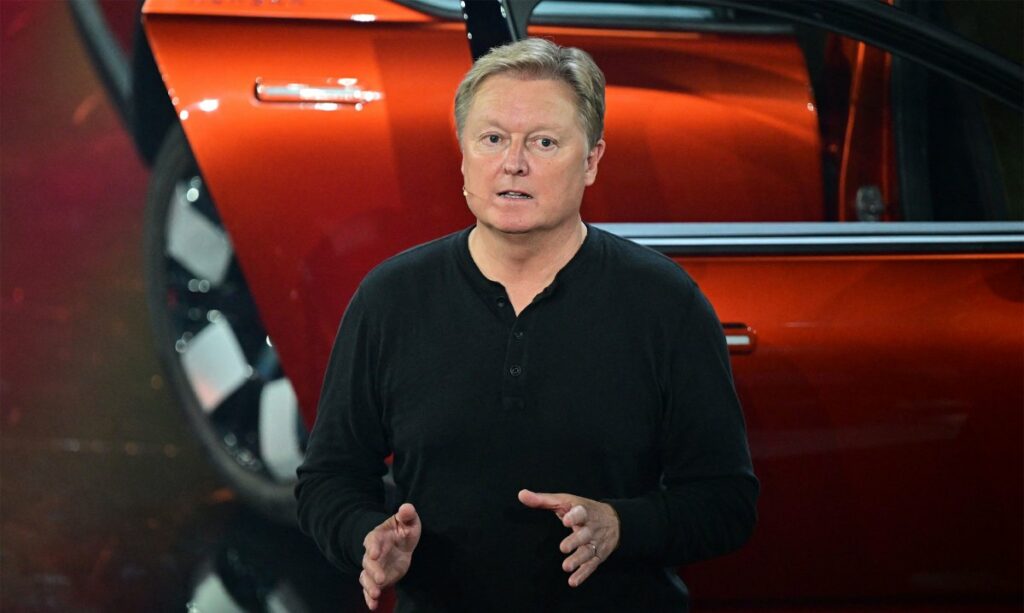

Uber chief executive officer Dara Khosrowshahi outlined the plans in a press conference in Seoul, where he also kicked off a campaign to grow the company’s pool of drivers in the country.

That will need to be a major effort. Currently Korea’s ridehailing indstury is dominated by Kakao Taxi, Kakao Mobility’s consumer service, with more than 23 million registered users and a 98% market share, per Statista.

Khosrowshahi also added that Uber plans to expand its partnerships with Korean car technology companies, just as it has done in other markets.

It’s been especially active on that front recently. Last week, Cruise, General Motors’s self-driving subsidiary, signed a multi-year partnership with Uber to bring its robotaxis to the ride-hailing platform in 2025. Uber announced this week it had made a strategic investment in Wayve, a U.K.-based startup that develops software for autonomous driving. Uber already works with Korea’s Hyundai in other markets like Europe.

Uber ramping up in South Korea is the latest chapter in the drama that is the country’s hide-hailing market.

Although Uber has gained notoriety around the world for how it has head-butted with regulators, in South Korea, more recently it has been the home-grown dominant player that has had that dubious honor.

The country’s antitrust watchdog Fair Trade Commission fined Kakao Mobility $20 million for manipulating its algorithms to favor its own taxi franchise in Februrary 2023. However, it did not file a complaint with the prosecution then.

But in December last year, South Korean authorities asked the antitrust regulator to file a complaint against Kakao Mobility for algorithm manipulation favoring its own cabs, a repeat of the issue in February 2023. (For background, the Kakao app lets both franchise and non-franchise taxis pick up ride requests. Even if non-franchise taxis are closer, franchise taxis can still receive requests from clients.)

Uber has not escaped controversy in the country.

Uber first opened for business in South Korea a decade ago, and soon after that, taxi drivers began to organise protests over what they saw as a threat to their livelihood. Seoul city authorities eventually announced it would ban the service in late 2013.

It began those steps months later — although Uber did not completely exit the market. In 2020, it set up a joint venture with TMAP Mobility, a ride-hailing unit of local carrier SK Telecom, to make a comeback in the country. The following year, the JV company, called UT, launched its taxi-hailing service.

Then, while still remaining a JV, that rebranded as Uber Taxi this March.

As a minor player with likely less than 10% of the market when you count up other hopefuls, Uber has found itself the underdog in the country, but growth is coming at a fast clip at the moment. Uber this week said the number of passengers increased by almost 80% in the first half of 2024, compared to the same period last year. Since the rebranding, there has also been a double increase in usage from international travelers.