Russia’s war in Ukraine and President Donald Trump’s reluctance to support NATO allies has led to a boost in funding for European defense tech. And across industries, startups are leveraging the opportunity.

One such company could be UK-based startup Vertical Aerospace, which is developing eVTOL (electric vertical takeoff and landing) aircraft mainly for air taxi operations. The startup has more than 1,500 pre-orders for its VX4 eVTOL from customers like American Airlines, Japan Airlines, GOL, and Bristow.

Now, Vertical is speaking more publicly about the opportunities in defense and logistics. On Monday, the Vertical took its first public step by announcing a plan to develop a hybrid-electric variant of its VX4.

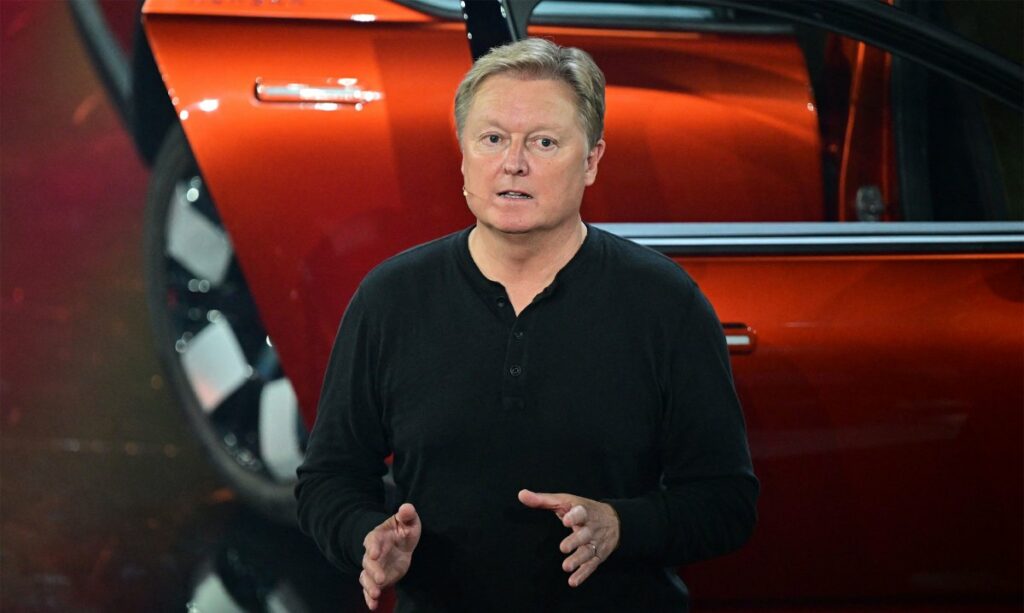

“We always knew this aircraft would be defense-capable because of the nature of it,” Vertical Aerospace CEO Stuart Simpson, told TechCrunch, noting the hybrid version of its eVTOL promises a range of up to 1,000 miles. That’s a 10-fold increase on the eVTOL.

VTOLs make for good defense aircraft because they have low noise and heat signatures. They can also be deployed autonomously or remotely, capabilities Vertical says its aircraft will one day have. Vertical has partnered with Honeywell, which is developing autonomous aircraft for the U.S. military, to create the flight control and aircraft management systems for its vehicles.

Vertical’s hybrid-electric strategy isn’t unique to the startup. In December 2024, California-based Archer Aviation announced a new unit dedicated to defense alongside plans to work with weapons manufacturer Anduril to build a hybrid-electric aircraft for critical military missions. The news garnered Archer another $430 million in equity from existing investors.

And while Simpson insists that Vertical isn’t coming out with the news of its hybrid vehicle now out of opportunism – the startup has been working on its hybrid aircraft in stealth for 18 months – it’s certainly good timing.

The European defense tech landscape has shifted over the past couple of years as the bloc prioritizes home-grown solutions. Last year, $1 billion in VC was invested into the industry for the first time, a fivefold increase since 2018. Specialist defense tech funds have also cropped up, like the €1 billion Nato Innovation Fund and the Estonian SmartCap €100 million defense fund. Lithuania is poised to spend 5% to 6% of its total GDP on defense spending, including into startups via its sovereign VC Coinvest Capital.

Against this backdrop, Vertical finds itself basically without European rivals in the eVTOL industry. At the close of 2024, Germany’s Volocopter filed for bankruptcy, and Lilium ceased operations. Vertical says this makes it uniquely positioned to meet the growing defense needs across Europe. And now, with its upcoming hybrid-electric capabilities, it could become a key player amid growing defense budgets and increased focus on sovereign industrial capacity.

To properly seize the moment, though, Vertical will likely need to raise more capital. The startup has raised $468.8 million to date, mainly through its reverse merger in 2021 and subsequent PIPEs, according to PitchBook. More recently, in January, Vertical raised $90 million through a second direct public offering.

That puts Vertical well below competitors Joby Aviation (raised $2.82 billion to date), Archer Aviation ($3.36 billion raised), and Beta Technologies ($1.15 billion).

“We’ve been spending about $100 million a year,” Simpson said. “Our competitors have been spending $400 to $500 million. We’ve been developing, within our $100 million spend envelope, this hybrid. We are incredibly efficient and focused.”

Archer’s operating expenses in 2024 did top $500 million, a chunk of which went towards resolving a dispute with Boeing and Wisk Aero. Joby’s operating expenses last year nearly reached $600 million.

That said, both Archer and Joby are investing heavily into manufacturing to be able to soon produce their eVTOLs at scale. Simpson said Vertical is not yet working to ramp up manufacturing before it finishes certification, which it expects to complete in 2028.

“You can burn a lot of money by going to build and get a load of robots,” Simpson said. “This is not something you want to robotize. These are highly, highly complex. What you need to do is understand how you build them, and then…you build a few hundred of them manually. Then you simplify, standardize, and automate.”

Vertical aims to have its first certified pre-prototype for its VX4 eVTOL built next year, with plans to build another handful after that.

“The hybrid power train will be integrated into our next generation VX4 variant with flight testing planned to start next year,” Simpson said Tuesday during Vertical’s first-quarter earnings call.

Vertical’s flight tests are only done with a pilot due, in part, to the stricter nature of UK flight regulations. Joby and Beta have already done piloted flights, but Archer still hasn’t – though it plans to do so imminently.

When it comes to customers for Vertical’s military offerings, the company hasn’t secured any just yet.

“We’ve had a lot of deep, meaningful discussions with government agencies and customers,” Simpson said. “But we’re the only European player in the space. So it gives us a really unique position.”