Cash App users can now pool money for group payments — even with non-users

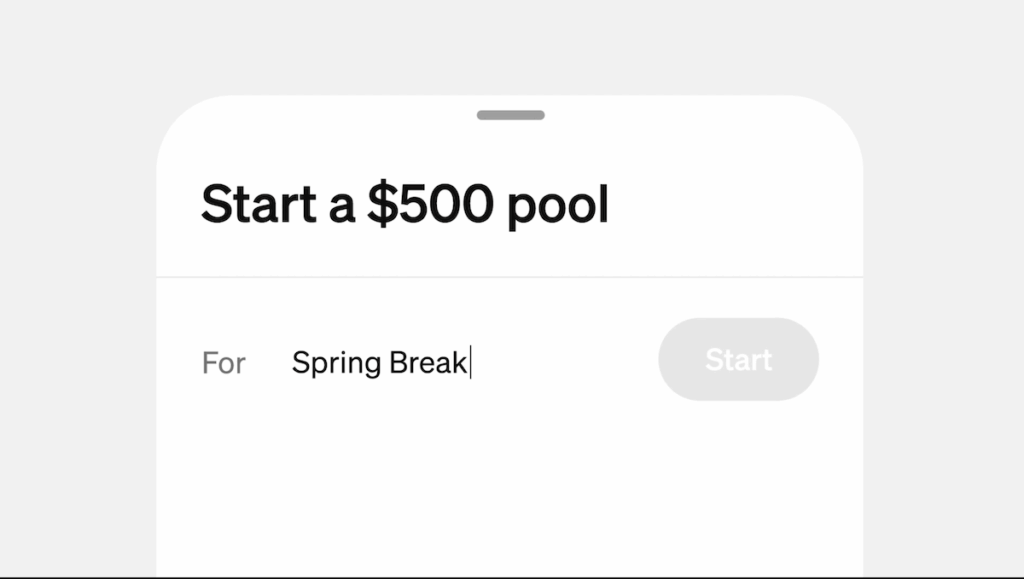

Cash App launched a new peer-to-peer payment feature on Tuesday called “Pools” that allows users to pool money with friends or family members to pay for expenses like grocery bills, restaurant checks, vacations, and group gifts. Initially available to select users, it will expand more widely in the coming months. Users can create Pools through […]

Cash App users can now pool money for group payments — even with non-users Read More »