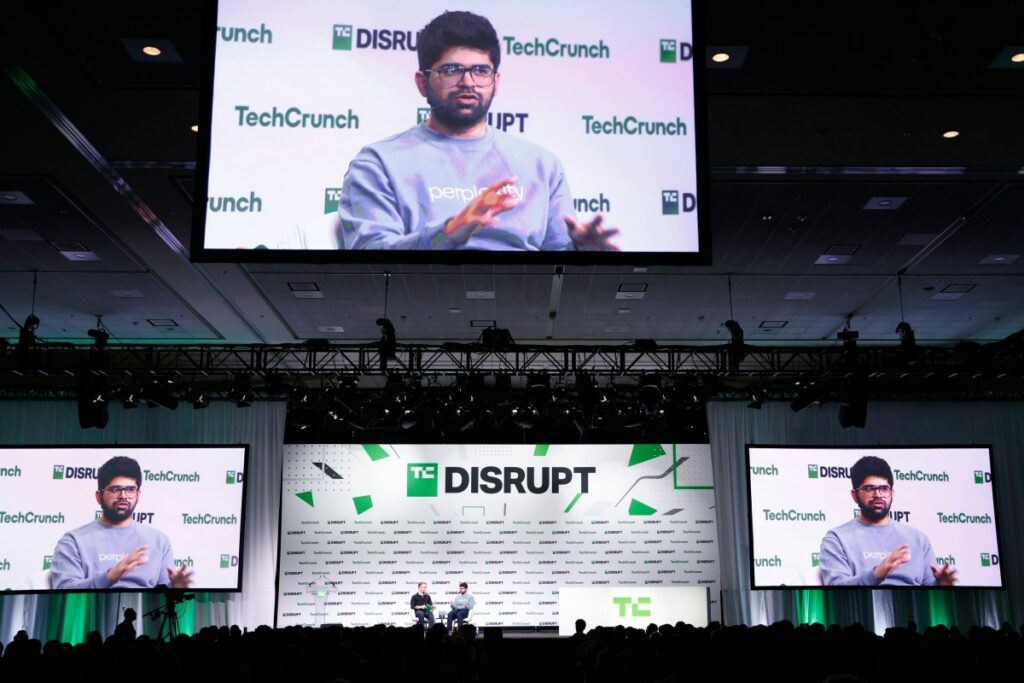

Roelof Botha explains why Sequoia supports Shaun Maguire after COO quit

During an interview at TechCrunch Disrupt 2025 on Monday, Sequoia Capital managing partner Roelof Botha defended his colleague, Sequoia partner Shaun Maguire, over the controversial comments Maguire made earlier this year, calling the firm a believer in his partner’s right to “free speech.” In a July 4 post on X, Maguire attacked New York City […]

Roelof Botha explains why Sequoia supports Shaun Maguire after COO quit Read More »