Gozem nets $30M to expand vehicle financing, digital banking in Francophone Africa

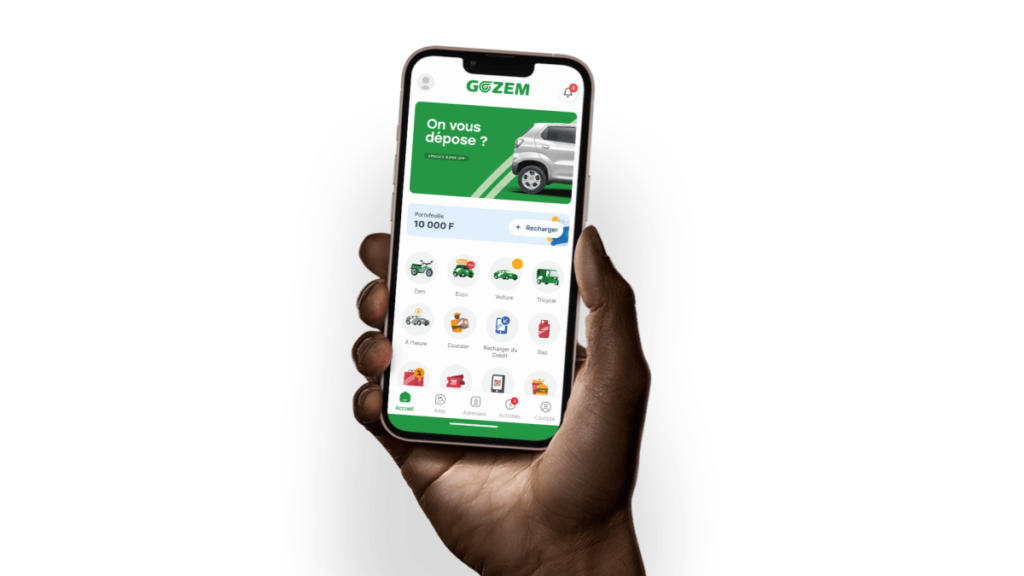

Since its launch in 2018 as a ride-hailing service in Togo, Gozem has steadily expanded across French-speaking West Africa, integrating a wide range of services as it sought to become a super-app. The company now offers ride-hailing, commerce, vehicle financing, and digital banking across Togo, Benin, Gabon, and Cameroon. Now, in a bid to scale […]

Gozem nets $30M to expand vehicle financing, digital banking in Francophone Africa Read More »