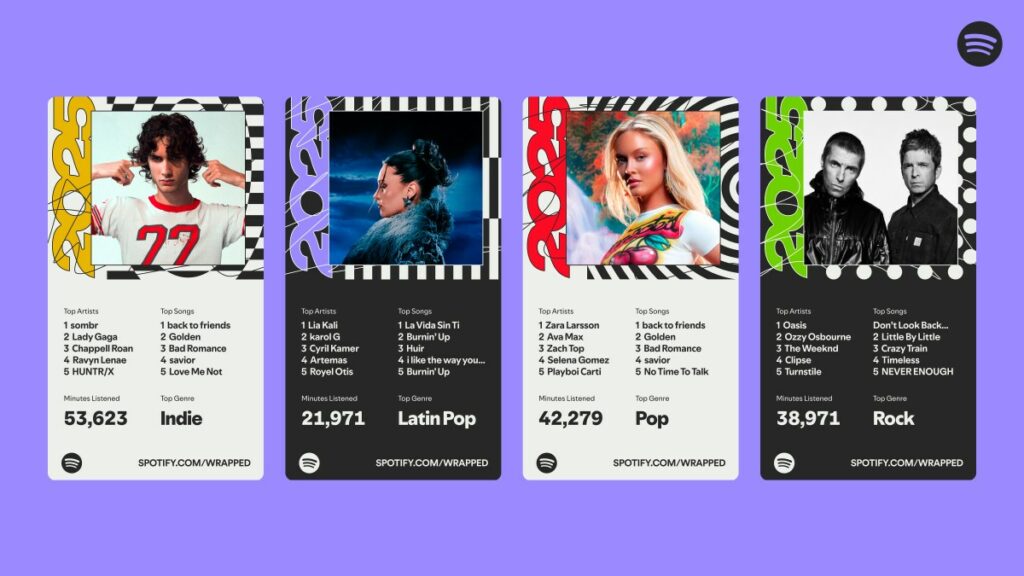

Nothing wants your money, AWS wants your trust, and Spotify wants your data

AWS announced a wave of new AI agent tools at re:Invent 2025, but can Amazon actually catch up to the AI leaders? While the cloud giant is betting big on enterprise AI with its third-gen chip and database discounts that got developers cheering, it’s still fighting to prove it can compete beyond infrastructure. This week […]

Nothing wants your money, AWS wants your trust, and Spotify wants your data Read More »