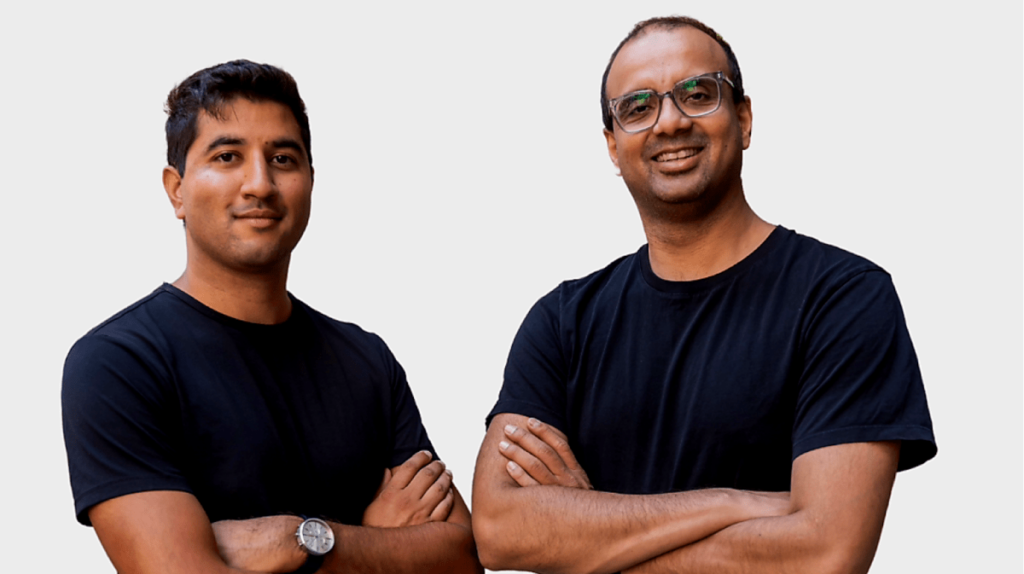

Farmblox puts the control into farmers’ hands with its AI-powered sensor-reading platform

Nathan Rosenberg, the founder of farm automation platform Farmblox, said if there is one thing to know about trying to sell technology to farmers, it’s that you can’t tell them what to do. “[Farmers] are multigenerational,” Rosenberg told TechCrunch. “It is not a profession, it’s more a community, a way of life, and you need […]